[Newsmp] GLP-1 RA Semaglutide and the GLP-1/GIP dual agonist Tirzepatide are dominating the diabetes treatment market.

The two ingredients are making waves at major diabetes conferences recently, providing productive blood sugar-lowering effects that exceed those of existing diabetes treatments of various classes, and unprecedented weight loss effects.

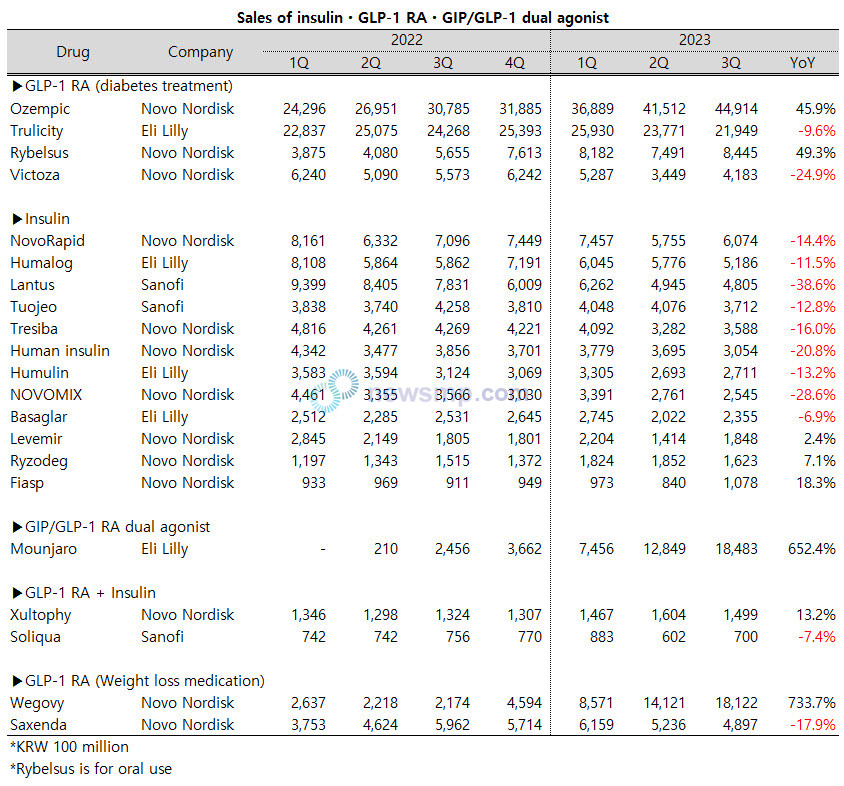

Semaglutide-containing Ozempic and Wegovy (both Novo Nordisk) and tirzepatide-containing Mounjaro (Eli Lilly) are shaking up the diabetes treatment market with their rapid growth and quarterly sales in the tens of billions of won.

Ozempic, an injectable diabetes treatment with the active ingredient semaglutide, posted sales of KRW 4.5 trillion in the third quarter.

Ozempic quickly became the best-selling injectable diabetes drug, selling more than twice as much as Trulicity (Eli Lilly), which had previously held that title.

Trulicity, which led the growth of the GLP-1 RA market by surpassing insulin, still maintains quarterly sales of over KRW 2 trillion, but its growth has recently stalled due to Ozempic's offensive and the generational change with Mounjaro.

Trulicity achieved sales of approximately KRW 2.2 trillion in the last quarter but experienced a negative growth of 9.6% compared to the same period last year.

Novo Nordisk's oral medication Rybelsus, which contains the semaglutide substance, is nearing the KRW 1 trillion mark once again in the third quarter, by surpassing KRW 80 billion with a growth rate approaching 50%.

Victoza, another GLP-1 RA drug from Novo Nordisk, was once the company's flagship product, but its quarterly sales have fallen below KRW 50 billion due to the introduction of semaglutide-based drugs.

Meanwhile, Mounjaro, which entered the market in the second quarter of last year, is threatening the incumbents with its rapid growth. In the third quarter of last year, its sales reached KRW 1.85 trillion, approaching the KRW 2 trillion mark.

With quarterly sales approaching KRW 2 trillion and year-over-year growth of 652%, Mounjaro is on track to easily surpass Trulicity in the fourth quarter if current trends continue.

Wegovy, a weight loss drug containing semaglutide, also posted sales of around KRW 1.8 trillion in the third quarter, up over 700% from the same period last year.

The combined quarterly sales of three semaglutide-based drugs, Ozempic, Rybelsus, and Wegovy, exceeded KRW 7 trillion in the third quarter.

Similar to the diabetes treatment market, semaglutide-based drugs are also gaining ground in the weight loss treatment market, causing liraglutide-based Saxenda to see a decline in sales.

Saxenda, which maintained its growth even after the launch of Wegovy, surpassed KRW 6 trillion in the first quarter of last year but has seen two consecutive quarters of contraction, with sales falling below KRW 5 trillion in the third quarter.

With the dominance of GLP-1 class diabetes treatments, the insulin market is significantly shrinking.

In the insulin market, flagship products such as NovoRapid (Novo Nordisk), which surpassed Lantus (Sanofi) to become the top-selling product, and Humalog (Eli Lilly) are showing double-digit declines in sales.

Lantus, which had long held the top spot in the injectable diabetes treatment market, has also seen its quarterly sales fall below KRW 500 billion for two consecutive quarters.

Not only Lantus, but also Tuojeo (Sanofi) and Tresiba (Novo Nordisk) posted double-digit negative growth rates.

Despite the fact that Levemir, Ryzodeg, and Fiasp (Novo Nordisk) saw sales growth in the third quarter compared to the same quarter last year, their quarterly sales still fell short of KRW 20 billion, which was lower than other insulin products that recorded negative growth rates.

Moreover, the quarterly sales of Xultophy (Novo Nordisk) and Soliqua (Sanofi), which are combination products of insulin and GLP-1 RAs, have also shown signs of stagnation, with sales of KRW 1.5 billion and KRW 700 million.