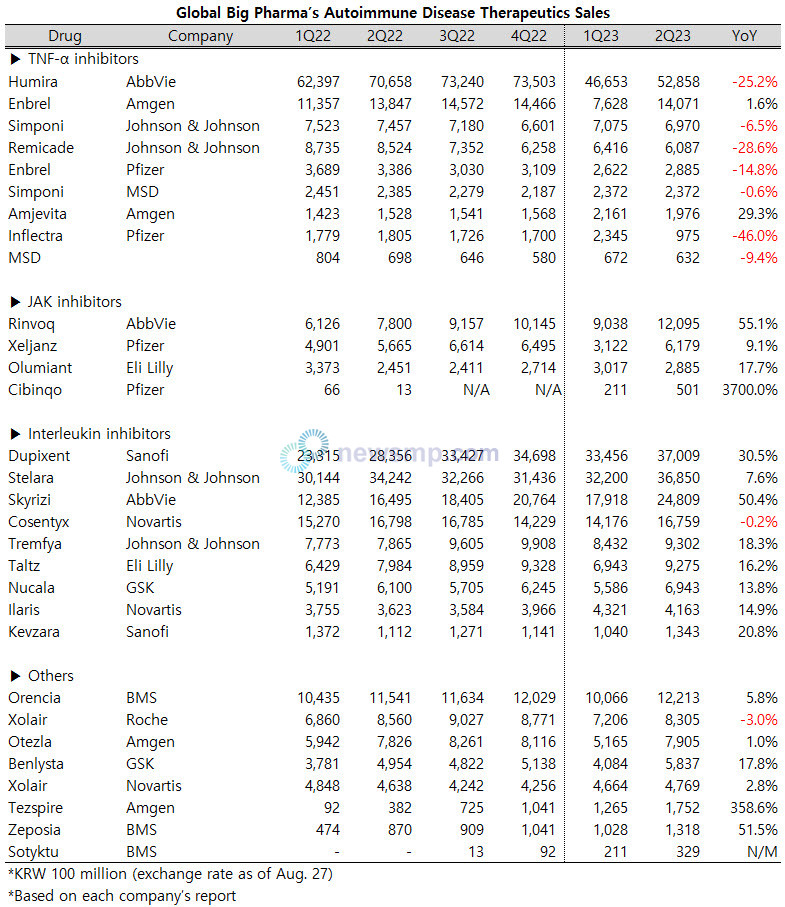

[Newsmp] In the midst of a recovery to its previous state after a substantial decline in the first quarter in the autoimmune disease treatment market, Humira, Dupixent, and Stelara are in command.

According to the reports of major global Big Pharma, the sales of large items in the autoimmune disease treatment market have mostly recovered to the previous year's level, after a significant decrease in the first quarter.

Humira (AbbVie), the top-selling autoimmune disease treatment, had its quarterly revenue shrink to KRW 4.7 trillion in the first quarter of this year from over KRW 7 trillion in the past but has recovered to KRW 5.3 trillion in the second quarter. (exchange rate as of August 8)

Dupixent (Sanofi), which slowed down in the first quarter after maintaining steady growth, expanded its sales again and rose to KRW 3.7 trillion.

Stelara (Janssen), which had allowed Dupixent to take the lead, also experienced a resurgence in growth and narrowed the gap with Dupixent by KRW 15 billion from KRW 300 billion.

After surpassing 2 trillion won in the fourth quarter of last year, Skyrizi (AbbVie) retreated to KRW 1.8 trillion in the following quarter. However, in the second quarter, it rebounded to KRW 2.5 trillion, injecting tension into the leading group.

With quarterly sales close to KRW 1.7 trillion, Cosentyx (Novartis), which had maintained around 1.4 trillion won for the past two consecutive quarters, has once again restored its previous levels.

Furthermore, Enbrel (AmgenㆍPfizer) witnessed a significant decrease in Amgen's sales, nearly halving from around KRW 1.4 trillion to about KRW 700 billion in the first quarter, but it rebounded back to around KRW 1.4 trillion in the second quarter.

Rinvoq (AbbVie), after exceeding KRW 1 trillion in the fourth quarter of last year, saw its sales decline to nearly KRW 900 billion in the first quarter but has now surpassed KRW 1.2 trillion.

Xeljanz (Pfizer) experienced a decrease in quarterly sales from over KRW 600 billion to around KRW 300 billion in the first quarter, but it managed to rebound to the KRW 600 billion range in the second quarter.

Tremfya (Janssen) and Taltz (Eli Lilly), which both recorded sales in the KRW 900 billion range in the previous fourth quarter, saw declines to KRW 840 billion and KRW 690 billion in the first quarter, then returned to the KRW 900 billion range in the second quarter.

Orencia (BMS), similarly, regained the KRW 1.2 trillion range, after retreating to 1 trillion won in the first quarter.

In contrast, biosimilars that had shown positive growth in the previous first quarter faced a downturn as they moved into the second quarter.

Amjevita (Amgen), which had risen to KRW 200 billion in the first quarter, fell back to KRW190 billion, and Inflectra (Pfizer), which had exceeded KRW 230 billion in the first quarter, saw its sales shrink to KRW 90 billion.

While the TNF-α inhibitor market witnesses a decline due to numerous patent-expired products, the market for interleukin (IL) inhibitors and Janus Kinase (JAK) inhibitors continues to experience growth.

In the TNF-α inhibitor market, Humira, along with Simponi and Remicade (JanssenㆍMSD), all recorded underwhelming performances compared to the same period of the previous year. However, Amgen's Enbrel saw a slight increase in sales, while Pfizer's revenues decreased by around 15%.

Among them, Amjevita saw a growth of nearly 30% in the second quarter of 2023 compared to the same period last year, which is a relatively good performance compared to other TNF-α inhibitors.

The JAK inhibitor market, which experienced difficulties due to safety concerns, is on the path to recovery. In the midst of this, Rinvoq, taking the lead as the top product within its category, achieved a growth rate of 55%, while both Xeljanz and Olumiant also managed to regain their growth momentum. Moreover, the newly introduced Cibinqo has exceeded KRW 50 billion in sales.

The interleukin inhibitor market saw most major products achieve double-digit growth rates with their impressive performances.

While the top product Dupixent achieved a growth rate exceeding 30%, Skyrizi, Tremfya, Taltz, Nucala (GSK), Ilaris (Novartis), Kevzara (Sanofi), and more recorded substantial growth rates regardless of indications.

However, Cosentyx showed a slightly subdued performance compared to the same period in the previous year, and Stelara recorded a growth rate in the single digits, relatively indicating a less impressive performance.

Meanwhile, Sotyktu (BMS), the first allosteric Tyrosine Kinase 2 (TYK2) inhibitor to emerge in the psoriasis treatment market, surpassed KRW 30 billion in sales within four months of its launch.