Mounjaro reached KRW 250 billion in two quarters… Lantus’ growth rate reduced

[Newsmp] The trend in the injectable diabetes treatments market is shifting toward GLP-1 RA.

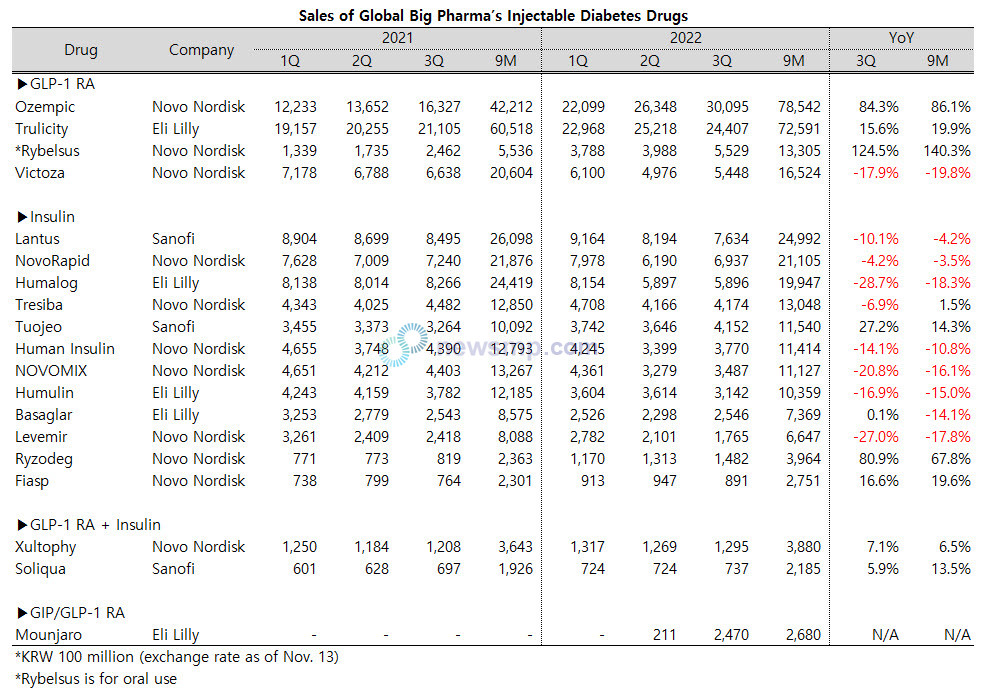

According to quarterly reports of major global Big Pharma, Ozempic (Novo Nordisk) earned KRW 3 trillion in sales in the third quarter (based on the exchange rate on Nov. 13).

Ozempic has grown steeply since its launch, exceeding KRW 2 trillion in the first quarter, and in the third quarter, it rose to the KRW 3 trillion mark.

Ozempic, which surpassed Trulicity (Eli Lilly) with sales of about KRW 2.63 trillion in the second quarter and became a market leader among injectable diabetes drugs, expanded its sales by nearly KRW 400 billion in the third quarter.

Trulicity maintained double-digit growth compared to the same period last year but slightly decreased from the previous quarter when it exceeded KRW 2.5 trillion.

The cumulative sales for three quarters for Ozempic were about KRW 7.85 trillion and Trulicity about KRW 7.3 trillion, widening the gap between the two.

Above all, it is expected that Ozempic will continue to lead the market as it still maintains a growth rate of more than 80%.

In the meantime, Rybelsus (Novo Nordisk), which was approved as the first oral drug among GLP-1 RA, also grew sharply and expanded its sales to KRW 550 billion in the third quarter.

On the other hand, sales of Victoza (Novo Nordisk) decreased by nearly 20% due to the generational change, lagging behind Rybelsus.

In the insulin market, Lantus (Sanofi) still maintained its lead with sales of KRW 760 billion amid a drop in sales of other drugs.

But Lantus’ third-quarter sales fell 10.1% compared to the same period last year, retreating from the KRW 800 billion mark that had been difficult to keep as the decline increased.

Sales of major drugs such as NovoRapid (Novo Nordisk), Humalog (Eli Lilly), NOVOMIX (Novo Nordisk) and Humulin (Eli Lilly) have also slid by more than 10%.

Tresiba (Novo Nordisk) released as an opponent to Lantus, also saw its sales decrease in the third quarter from the same quarter last year.

Instead, Tuojeo (Sanofi), Tresiba’s competitor, grew by 27.7% to the KRW 400 billion mark from the KRW 300 billion mark, standing on the same level as Tresiba.

The mixed insulin Ryzodeg (Novo Nordisk) and fast-acting insulin Fiasp (Novo Nordisk) recorded double-digit growth, and sales amounted to about KRW 150 billion and KRW 90 billion.

GLP-1 RA and insulin combined drugs Xultophy (Novo Nordisk) and Soliqua (Sanofi) showed 6~7% growth, with quarterly sales of KRW 130 billion and KRW 74 billion.

Meanwhile, Mounjaro (Eli Lilly), GIP and GLP-1 RA that is captivating for strong low blood sugars and remarkable weight loss effects compared to existing diabetes treatments achieved sales of KRW 250 billion in the second quarter after its launch.