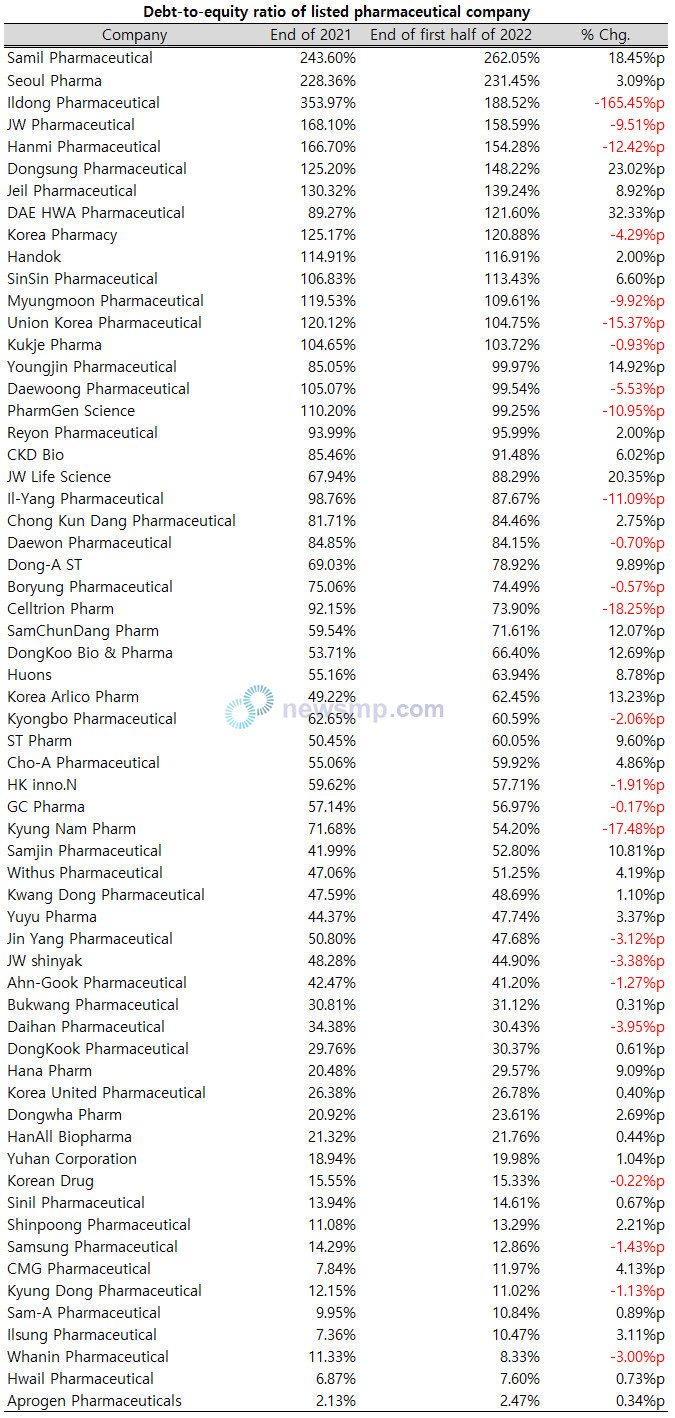

[Newsmp] The debt-to-equity ratio of more than half of listed pharmaceutical companies rose in the first half. However, the average debt-to-equity ratio was still below 60%.

Newsmp tallied the first half debt-to-equity ratio of 62 drug makers, whose closing accounts are in December, and found that the debt-to-equity of 37 companies, which accounted for more than half, was higher than at the end of last year.

DAE HWA Pharmaceutical had the larger increase at 32.33%p, Dongsung Pharmaceutical at 23.03%p and JW Life Science at 20.35%p, and Samil Pharmaceutical, Youngjin Pharmaceutical, Korea Arlico Pharm, DongKoo Bio & Pharma, SamChunDang Pharm, and Samjin Pharmaceutical rose more than 10%p in the debt-to-equity ratio.

On the other hand, the debt-to-equity ratio of 25 companies decreased from the end of last year. In particular, Ildong Pharmaceutical, whose debt-to-equity ratio exceeded 300% at the end of last year, plunged 165.45%p and halved compared to the end of the year.

In addition, the debt-to-equity ratio of Celltrion Pharm, Kyung Nam Pharm, Union Korea Pharmaceutical, Hanmi Pharmaceutical, Il-Yang Pharmaceutical, and PharmGen Science retreated by more than 10%.

Although the debt-to-equity ratio of more than half of the listed pharmaceutical companies increased, the average debt-to-equity ratio of 62 companies fell slightly from 59.40% at the end of last year to 59.30% at the end of the first half.

As of the end of the first half, Samil Pharmaceutical had the highest debt-to-equity ratio of 262.05%, exceeding 200% with Seoul Pharma of 231.45%.

Ildong Pharmaceutical eased to 188.52%, followed by JW Pharmaceutical with 158.59%, and Hanmi Pharmaceutical with 154.28%.

Dongsung Pharmaceutical, Jeil Pharmaceutical, DAE HWA Pharmaceutical, Korea Pharmacy, Handok, SinSin Pharmaceutical, Myungmoon Pharmaceutical, Union Korea Pharmaceutical, and Kukje Pharma exceeded 100% in the debt-to-equity ratio.

Youngjin Pharmaceutical, Daewoong Pharmaceutical, PharmGen Science, Reyon Pharmaceutical, and CKD Bio are in the 90% range, and JW Life Science, Il-Yang Pharmaceutical, Chong Kun Dang Pharmaceutical, and Daewon Pharmaceutical in the 80%, and Dong-A ST, Boryung Pharmaceutical, Celltrion Pharm, and SamChunDang Pharm in the 70% range, and DongKoo Bio & Pharma, Huons, Korea Arlico Pharm, Kyongbo Pharmaceutical, and ST Pharm in the 60% range, exceeding the average.

Cho-A Pharmaceutical, HK inno.N, GC Pharma, Kyung Nam Pharm, Samjin Pharmaceutical, and Withus Pharmaceutical followed with 50% range, and Kwang Dong Pharmaceutical, Yuyu Pharma, Jin Yang Pharmaceutical, JW shinyak, and Ahn-Gook Pharmaceutical with 40% range, and Bukwang Pharmaceutical, Daihan Pharmaceutical, DongKook Pharmaceutical, Hana Pharm, Korea United Pharmaceutical, Dongwha Pharm, and HanAll Biopharma with 20% range.

Yuhan Corporation, Korean Drug, Sinil Pharmaceutical, Shinpoong Pharmaceutical, Samsung Pharmaceutical, CMG Pharmaceutical, Kyung Dong Pharmaceutical, Sam-A Pharmaceutical, and Ilsung Pharmaceutical are counted in the 10% range, while Whanin Pharmaceutical, Hwail Pharmaceutical, and Aprogen Pharmaceuticals are in single digits.