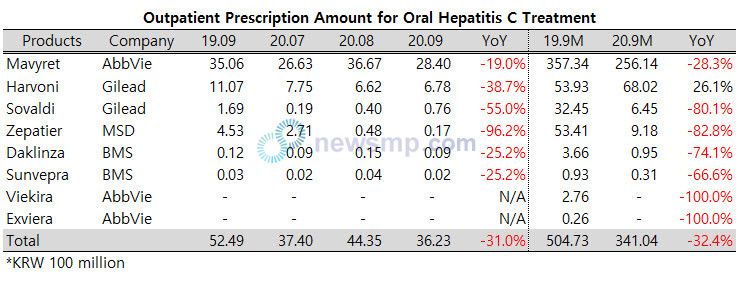

SovaldiㆍZepatier fell below KRW 100 million (USD 90,000) in monthly prescription

Monthly prescription for Mavyret is under KRW 3 billion (USD 2.7 million)

As the National Health Screening Program for hepatitis C has yet to bear fruit, the market for related treatments is also shrinking.

Mavyret (AbbVie), with KRW 10 billion (USD 890,000) level prescriptions alone, has decreased its prescription amount significantly, while Harvoni (Gilead), which rebounded due to expansion of indications, saw its pullback.

Sovaldi (Gilead) and Zepatier (MSD) have virtually lost their presence, with monthly prescriptions below KRW 100 million (USD 90,000).

The pilot project for early detection of hepatitis C patients began in September with a two-month temporary schedule, but it did not change the contraction trend.

According to the UBIST, Mavyret’s prescription amount was KRW 2.8 billion (USD 2.5 million) in September, down 19.0% YoY.

It was expected to have the effect of the pilot project in September but rather retreated to the KRW 2.8 billion (USD 2.5 million) level from KRW 3.7 billion (USD 3.31 million) in August.

Mavyret’s 9-month cumulative prescription amount was KRW 25.6 billion (USD 22.9 million), which was the only hepatitis C treatment that exceeded KRW 10 billion (USD 890,000), but it dropped by 28.3% YoY.

Harvoni, which rebounded from genotype 1 and reborn to all hepatitis C genotypes treatments, also recently entered a negative growth trend.

In September, its prescription amount remained around KRW 600 million (USD 537,730), down 38.7% YoY, but the 9-month cumulative prescription amount was KRW 6.8 billion (USD 6 million), still 26.1% up YoY.

While Mavyret and Harvoni have maintained their presence in the market, other DAA (Direct Acting Antivirals) have lost their footing.

Sovaldi’ (Gilead) prescription amount was only KRW 76 million (USD 68,000) and Zepatier’ (MSD) sunk to KRW 17 million (USD 15,230) in September.

The 9-month cumulative prescription amount for Sovaldi and Zepatier plunged more than 80% YoY to KRW 645 million (USD 578,000) and KRW 918 million (USD 823,000).

Although Daklinza and Sunvepra (BMS), which opened the era of DAA, were below KRW 10 million (USD 9,000), prescriptions were still being counted.

Meanwhile, Viekira and Exviera (AbbVie) had dropped in prescription amount after passing the barton to Mavyret, and outpatient prescriptions were not calculated this year.