[Newsmp] Retail investors showed no interest in the pharmaceutical index's November comeback, despite its positive performance.

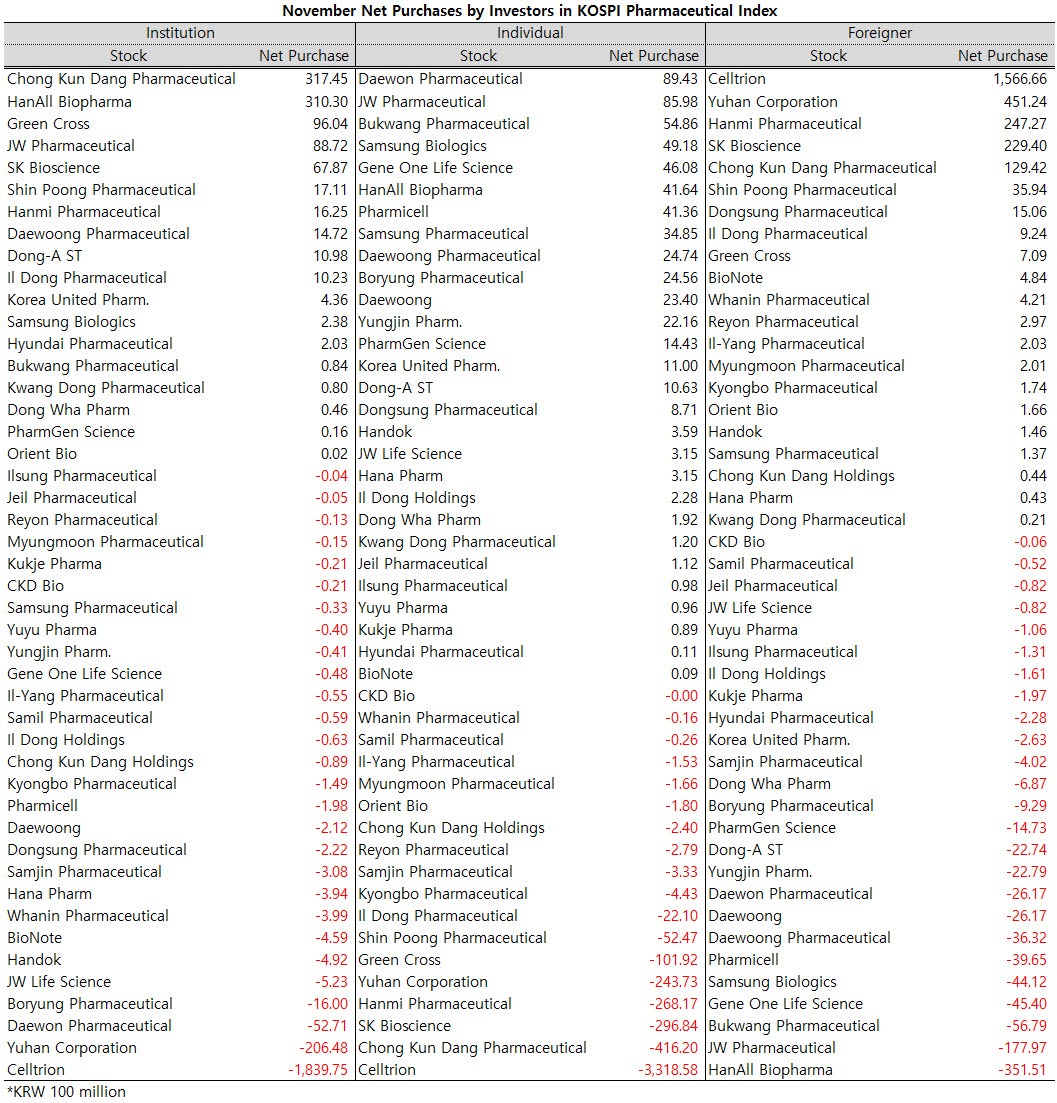

In November, individual investors sold 6 of the 47 pharmaceutical stocks in the KOSPI market for more than KRW 10 billion, according to Newsmp's tally of net purchase amounts by investor type.

In November, individual investors bought more than they sold in 28 of the 46 KOSPI pharmaceutical index constituents, more than half of the total.

However, none of the 28 stocks had individual investor net purchases of over KRW 10 billion.

In contrast, individual investors sold Celltrion, which pursued a merger, for KRW 331.9 billion, and Chong Kun Dang Pharmaceutical for over KRW 40 billion.

In addition, the net selling volume of SK Bioscience by retail investors was close to KRW 30 billion, Hanmi Pharmaceutical and Yuhan Corporation over KRW 20 billion, and Green Cross over KRW 10 billion.

In the same period, only 18 stocks had institutional buying exceeding institutional selling.

In spite of the overall trend of institutional selling, institutional investors were net buyers of Chong Kun Dang Pharmaceutical and HanAll Biopharma, each buying more than KRW 30 billion, while they offloaded KRW 184 billion worth of Celltrion and KRW 20.6 billion of Yuhan Corporation.

Foreign investors also bought more than they sold in only 21 of the 46 stocks during this period, less than half.

According to a tally, foreign investors bought a net of KRW 156.7 billion worth of Celltrion and KRW 45.1 billion worth of Yuhan Corporation.

In addition to Celltrion and Yuhan Corporation, Hanmi Pharmaceutical, SK BioScience, and Chong Kun Dang Pharmaceutical also saw significant buying from foreign investors, with net purchases reaching KRW 24.7 billion, KRW 22.9 billion, and KRW 12.9 billion, respectively.

On the other hand, foreign investors sold off HanAll Biopharma for KRW 35.2 billion and JW Pharmaceutical for KRW 17.8 billion.