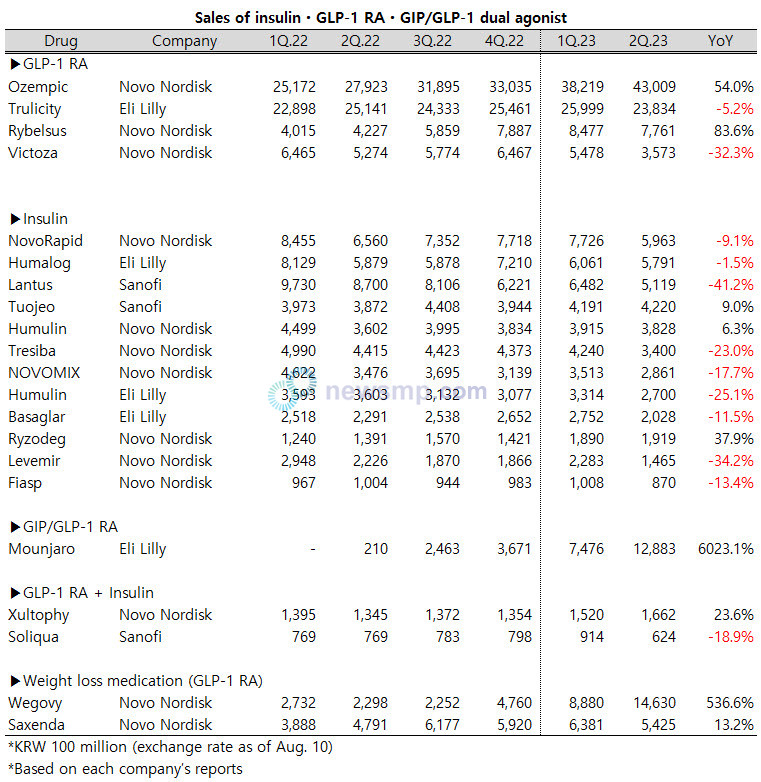

[Newsmp] GLP-1 analogs are expanding their sales beyond diabetes to obesity, leading to significant growth in size.

According to each company's report, major injection-type metabolic disease treatments such as insulin, GLP-1 analogs, and dual GIP/GLP-1 receptor agonists are increasingly becoming major items, with quarterly sales exceeding KRW 1 trillion.

Ozempic (Novo Nordisk) rose as the top injectable diabetes treatment in the market, surpassing Trulicity, and in the second quarter, it achieved a significant growth rate of 54%, boosting its sales to KRW 4.3 trillion (exchange rate as of Aug 10).

Ozempic went up from KRW 3.3 trillion in the fourth quarter of last year to KRW 3.8 trillion in the first quarter, and further to KRW 4.3 trillion in the second quarter, expanding its sales by KRW 500 billion each quarter for the past two quarters.

Wegovy (Novo Nordisk), an obesity treatment with the same ingredient (semaglutide), has also experienced substantial growth.

Wegovy's sales were in the KRW 200 billion range until the third quarter of last year but increased to KRW 480 billion in the fourth quarter, KRW 890 billion in the first quarter, and KRW 1.46 trillion in the second quarter, exceeding 1 trillion in a single quarter, surpassing KRW 1 trillion in a short span.

In contrast, the oral medication Rybelsus (Novo Nordisk) with the same ingredient as Wegovy, which had surpassed KRW 800 billion in the first quarter and approached the KRW 1 trillion mark, experienced a setback in the second quarter with sales of KRW 780 billion.

The sales of Ozempic and Wegovy, which are taken once a week, increased significantly in the second quarter, while the sales of Victoza and Saxenda, which are administered once a day, decreased slightly in the second quarter compared to the first quarter.

Mounjaro (Eli Lilly), the first GIP and GLP-1 receptor agonist to join the diabetes treatment market last year, also reached sales of approximately KRW 1.3 trillion in the last second quarter and surpassed the KRW 1 trillion mark within a year.

Tirzepatide, the main ingredient of Mounjaro, has the strongest data for both obesity and diabetes. If its indication is expanded to obesity by the end of the year, it is expected that the duopoly between tirzepatide and semaglutide will become more solidified.

Trulicity (Eli Lilly), which pioneered the once-weekly market and surpassed KRW 1 trillion, still maintains quarterly sales of more than KRW 2 trillion, but its growth has stagnated since the appearance of latecomers.

Conversely, while GLP-1 analogs are thriving, the insulin market is experiencing a major downturn due to a lack of new drugs to support its growth.

While leading groups such as NovoRapid (Novo Nordisk), Humalog (Eli Lilly), and Lantus (Sanofi), which recorded sales of KRW 600 to 700 billion in the first quarter, were pushed back to KRW 500 billion, Tresiba, Novomix, Levemir, Fiasp (Novo Nordisk), Humulin, and Basaglar (Eli Lilly) also saw a significant drop in sales.

Tuojeo and Ryzodeg were the only two insulins that saw an increase in sales in the first quarter. Ryzodeg performed particularly well, with sales approaching KRW 200 billion.

The insulin and GLP-1 RA combination drugs Xultophy and Soliqua had different results. Xultophy recorded sales of over KRW 150 billion for the second consecutive quarter, with growth of more than 20%. Soliqua, which rose to KRW 90 billion in the first quarter, fell back to KRW 600 billion.