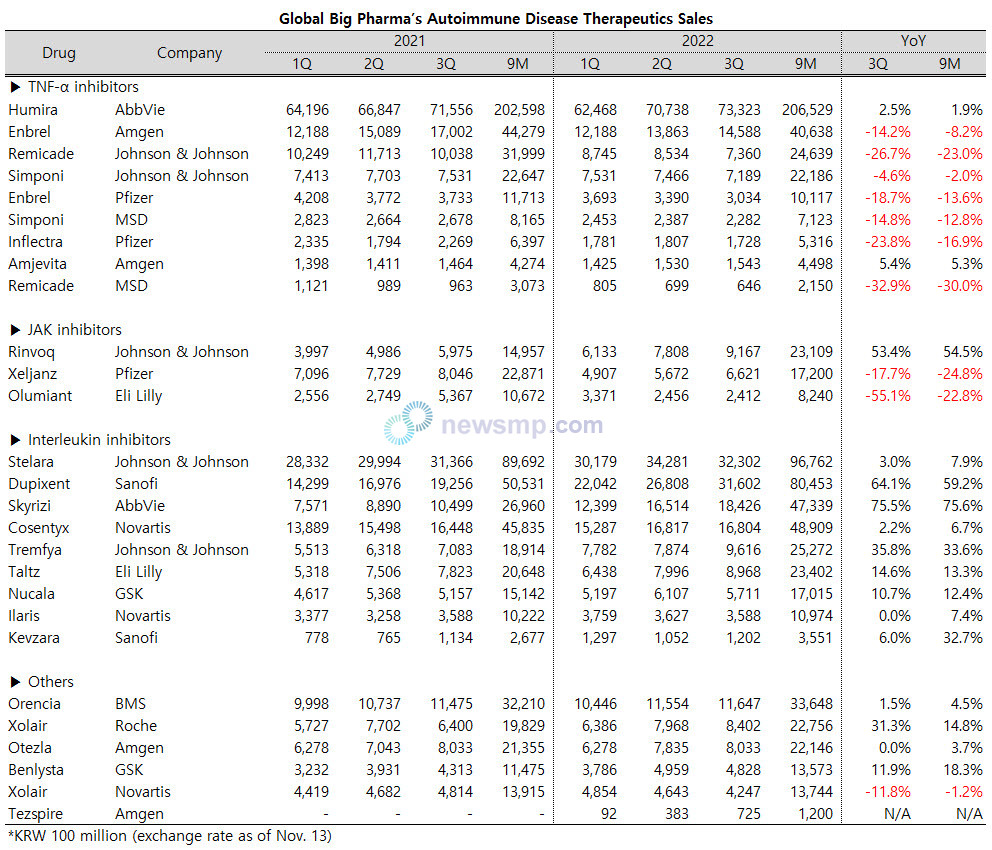

Rinvoq leads the JAK inhibitors market

[Newsmp] The autoimmune disease therapeutics market is fluctuating.

In the interleukin inhibitors market, Skyrizi (AbbVie) surpassed Cosentyx (Novartis), and Tremfya (Johnson & Johnson) went beyond Taltz (Eli Lilly), while Dupixent is on par with Stelara (Johnson & Johnson).

Rinvoq (AbbVie), a latecomer, exceeded the forerunners one after another and solidified its dominance in the JAK inhibitors market.

In the TNF alpha inhibitors market, Humira (AbbVie) continued to grow despite the onslaught of biosimilars.

According to quarterly reports of major global Big Pharma, Dupixent surpassed KRW 3 trillion with a growth rate of above 60% in the third quarter, on the same level as Stelara.

Dupixent started with sales of KRW 2.2 trillion in the first quarter and expanded its sales by about KRW 480 billion every quarter, exceeding KRW 3.1 trillion in the third quarter.

Stelara also posted sales of about KRW 3.2 trillion during the same period, but since each company’s reports count performance in different currencies, it is difficult to estimate the leader considering the exchange rate.

Skyrizi, which rose to the bottom of Cosentyx in the second quarter, succeeded in reversing in the third quarter.

Skyrizi’s sales were about KRW 1.85 trillion and Cosentyx’s KRW 1.68 trillion in the third quarter, and the gap between the two is expected to widen in the future as Cosentyx’s growth has stagnated, while Skyrizi maintains a growth rate of more than 70%.

Tremfya, which stood shoulder to shoulder with Taltz in the second quarter, posted sales of about KRW 960 billion in the third quarter, surpassing Taltz of KRW 900 billion.

In the JAK inhibitors market, Rinvoq is showing dominance. While Xeljanz (Pfizer) and Olumiant (Eli Lilly), the first runners, continued their downward growth trend with sales of about KRW 660 billion and KRW 240 billion, Rinvoq alone maintained a growth rate of more than 50% and exceeded KRW 900 billion.

In the TNF-α inhibitors market, Humira sustains its growth despite the emergence of biosimilars and is still leading the autoimmune disease therapeutics market.

Humira’s sales in the third quarter increased by about KRW 180 billion to about KRW 7.33 trillion compared to the same period last year, overshadowing the biosimilars.

In addition, while major original products such as Enbrel (AmgenㆍPfizer), Remicade and Simponi (Johnson & JohnsonㆍMSD) saw their pullback, sales of Inflectra (Pfizer) have decreased by more than 20% from the same period last year, and Amjevita (Amgen) maintained sales of around KRW 150 billion with slight growth among biosimilars.

In the meantime, For Xolair, Roche's sales in the third quarter increased by more than 30% compared to the same period last year, while Novartis' sales decreased by more than 10%.

Sales of Orencia (BMS) and Otezla (Amgen) remained almost unchanged, and Tezspire (Amgen), licensed in the first quarter, rose to the KRW 70 billion mark in the third quarter.