Yervoy, double-digit growth by expansion of combination therapy

Three CAR-t achieved total sales of KRW 1.2 trillion

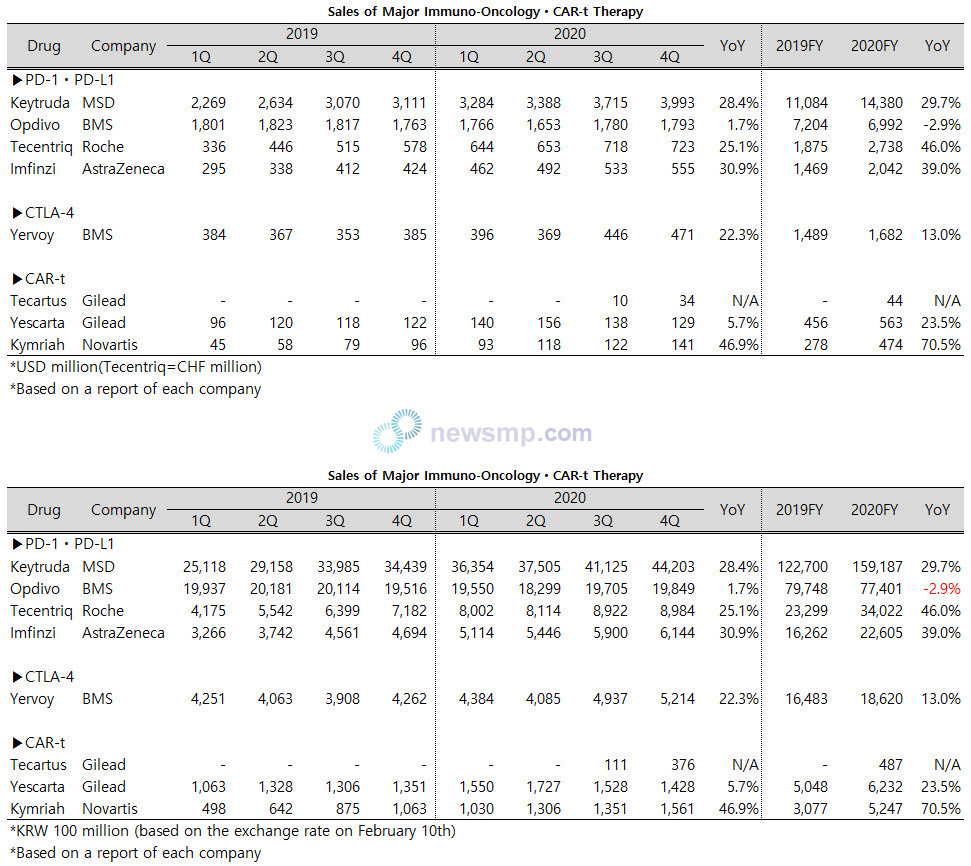

MSD Keytruda is solidifying its monopoly in the immuno-oncology market.

Keytruda accounted for half of the immuno-oncology market, according to a report compiled by Newsmp on major global Big Pharma.

Keytruda’s annual sales of last year amounted to KRW 16 trillion, up 29.7% from 2019. In particular, it achieved sales of nearly USD 4 billion (KRW 4.4 trillion) in 4Q (based on the exchange rate on February 10th).

Opdivo (BMS), which led the immuno-oncology market with Keytruda, recorded only KRW 7.74 trillion in sales last year, less than half of Keytruda.

Unlike other major immunotherapy growing at 30~40%, Opdivo alone fell into negative growth.

However, after peaking at USD 1.823 billion in 2Q of 2019 and retreating to USD 1.653 billion in 2Q of last year, Opdivo is recovering and gradually recovering its growth to USD 1.73 billion in 4Q.

Among them, Tecentriq (Roche) achieved sales of KRW 3 trillion and Imfinzi KRW 2.26 trillion, growing by 46.0% and 39.0% YoY.

While the fourth-quarter earnings have yet to be tallied, Bavencio (Merck) has made sales of EUR 10.5 billion (KRW 140 billion) by 3Q, with annual sales expected to be around KRW 200 billion.

CTLA-4 inhibitor Yervoy, which enlarged its sales through the expansion of combination therapy, achieved sales of KRW 1.86 trillion, while PD-1 inhibitors and PD-L1 inhibitors are leading the immuno-oncology market.

Meanwhile, CAR-t treatments, which attract attention by presenting new possibilities on hematologic malignancy, seem to be growing slower than expected.

Although three years have passed, the annual sales of CAR-t have remained at around KRW 1.2 trillion, including the recently newly added Tecartus (Gilead).

Yescarta (Gilead) took the lead with KRW 620 billion, followed by Kymriah (Novartis) with KRW 525 billion, and Tecartus with KRW 50 billion.

However, in the fourth-quarter, Kymriah overtook Yescarta, which was far ahead of Kymriah with KRW 170 billion in 2Q last year but decreased after the launch of Tecartus, with KRW 150 billion.