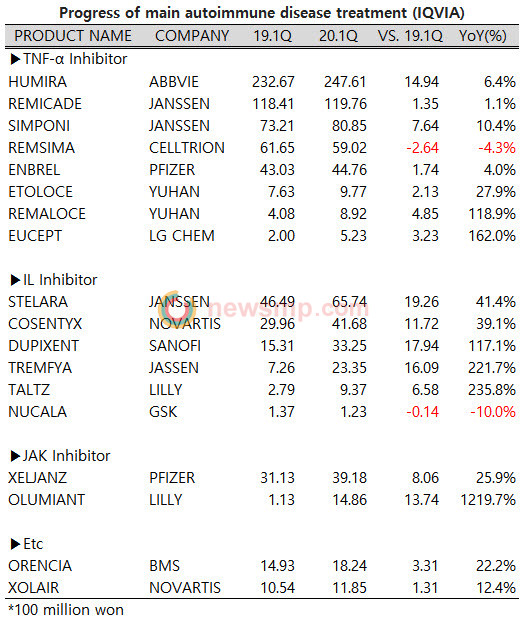

Xeljanz is at the head of the JAK inhibitor market… narrowed the gap with Olumiant

Humira (AbbVie) and Stelara (Janssen) are still in a solid position that draws attention.

Although there is a large number of latecomers in recent years, the company has increased its sales to widen the gap with latecomers.

According to IQVIA, Humira recorded $24.8 billion on sales in the last first quarter, which increased by 6.4% than last year’s.

The amount increased by $1.5 billion which was the largest growth among TNF-α inhibitors. Humira was the only drug among TNF-α inhibitors whose sales increased by more than $1 billion during the same period.

Simponi (Janssen) and Biosimilar are ahead in terms of growth rate, but the amount is overwhelming them.

Remicade (Janssen) followed with $12 billion, but the gap with Humira widened from $11.4 billion to $12.8 billion.

After Remicade, Simponi rose to $8.1 billion, while Remsima (Celltrion INC.) retreated nearly by $0.3 billion to $5.9 billion, followed by Enbrel (Pfizer) with $4.5 billion, Etoloce with about $1 billion, Remaloce (Yuhan Corp.) with $0.9 billion, and Eucept (LG Chem, Ltd) with $0.5 billion.

In the interleukin market, Stelara also had the largest increase (based on the amount). Despite safer and stronger latecomers appeared, Stelara’s quarterly sales rose nearly $2 billion than the same period of last year resulting in $6.6 billion.

Dupixent (Sanofi), which was registered as a treatment for severe atopic dermatitis last year and rapidly expanding its existence, could not reach Stelara’s increase in amount.

Sales of Cosentyx (Novartis) have increased $1.2 billion to $4.2 billion, and it threatens Stelara at the forefront, but the rate of increase is still behind Stelara’s, resulting in the gap from $1.7 billion to $2.4 billion.

Dupixent recorded $3.3 billion followed by Tremfya (Janssen) with $2.3 billion, Taltz (Lilly) with $0.9 billion, and Nucala (GSK) with $0.1 billion.

Even if Tremfya and Stelara are under the same company, Janssen, Tremfya is threatening the starters by reaching a growth rate of over 200%.

Taltz, with $0.9 billion sales, entered the market one step ahead than Tremfya, but the gap between them widened by $1 billion in a year.

The situation of the JAK inhibitor market is a little different. While Xeljanz (Pfizer) is still on the lead, Olumiant (Lilly) is catching up to narrow the gap.

Xeljanz, which approached $3 billion in the first quarter of last year with 26% growth, nearly reached $4 billion by expanding indication to the digestive field in advance.

However, Olumiant increased its sales to $1.5 billion and reduced the gap with Xeljanz by $0.6 billion from $3billion to $2.4 billion during the same period.

Meanwhile, T-cell targeted therapy Orencia (BMS) sales were up to $1.8 billion, still maintaining a growth trend of 20%, and also, chronic idiopathic urticaria treatment Xolair (Novartis) reported double-digit growth rate.