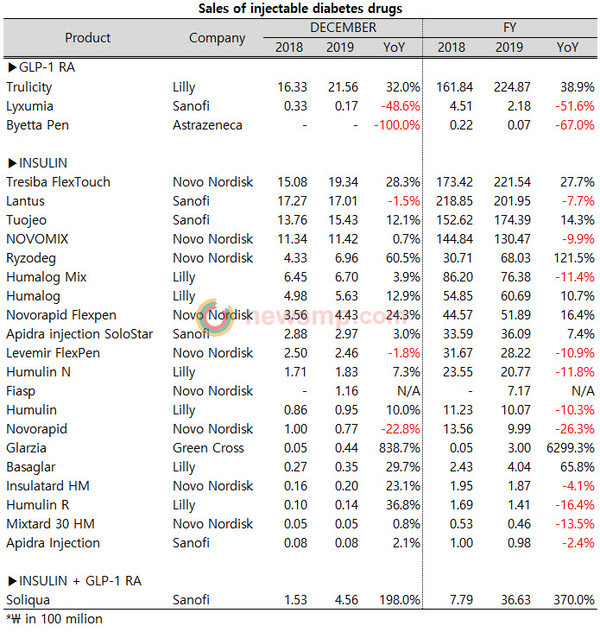

Followed by Tuojeo 17.4 billionㆍNovomix 13 billion

Ryzodeg 6.8 billionㆍSoliqua 3.6 billon, expanding scale

In the market for injectable diabetes drugs, three products — Trulicity(Lilly), Tresiba(Novo Nordisk), Lantus(Sanofi) — achieved 20 billion won mark in prescriptions.

Lantus, which was the only drug that reached 20 billion won mark in prescriptions with 21.9 billion won last year, maintained 20 billion mark again, achieving 20.2 billon won prescriptions despite the onslaught of latecomers.

Tresiba, which are on the offensive under the title of next-generation basal insulin, also reached 20 billion won prescriptions mark with increasing sales by 27.7% to 22.2 billion won.

Trulicity, which leads the GLP-1 analogue market alone, achieved 22.5 billion prescriptions last year with a growth rate of 38.9%, beating insulin drugs to become the leader in injectable diabetes drugs market.

Following them, Tuojeo(Sanofi) and Novomix(Novo Nordisk) recorded 17.4 billon won and 13 billion won prescriptions, respectively, reaching 10 billion won prescriptions mark.

Next, Humalog Mix(Lilly) recorded 7.6 billion won, Ryzodeg(Novo Nordisk) recorded 6.8 billion won, Humalog(Lilly) recorded 6.1 billion won, Novorapid Flexpen recorded 5.2 billion won, surpassing 5 billion won mark.

Among Lantus biosimilars, Basaglar(Lilly)’s sales expanded to 400 million won, while Glarzia(Green Cross)’s sales climbed to 300 million won. In particular, Glarzia is ahead of Basaglar in the latest monthly prescriptions.

Meanwhile, sales of Soliqua(Sanofi), a fixed-dose combination of GLP-1 analogue and insulin, expanded to mid-3 billion won, and ultra-fast acting insulin Fiasp(Novo Nordisk) achieved 700 million won prescriptions in the first year after launch.