[Newsmp] Semaglutide-containing products dominate diabetes and weight loss treatment market.

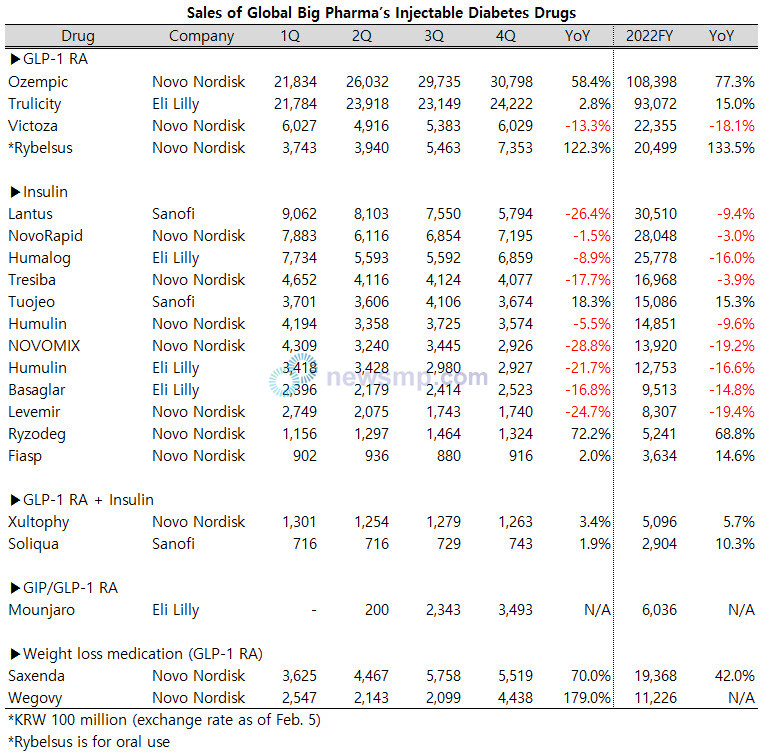

Semaglutide injection Ozempic (Novo Nordisk), once a week administration, achieved KRW 10.8 trillion in annual sales last year, beating Trulicity (Eli Lilly) and leading the injection diabetes treatment market, the reports found (each company’s report).

Ozempic , a latecomer in the GLP-1 RA market, began to lead Trulicity by a narrow margin from the first quarter of last year, widening the gap after the second quarter and surpassing KRW 3 trillion in the fourth quarter.

Even after rising to the top of the market, Ozempic is maintaining a growth rate of more than 50% compared to the same period last year (fourth quarter 2021 vs fourth quarter 2022).

Rybelsus, which is the same semaglutide ingredient but developed as an oral drug, also posted annual sales of more than KRW 2 trillion.

Although Rybelsus did not surpass Victoza (Novo Nordisk) in annual sales, it began to outperform Victoza in quarterly sales from the third quarter of last year.

Another semaglutide-containing drug, weight loss treatment Wegovy (Novo Nordisk), generated annual sales of KRW 1.1 trillion last year.

The combined annual sales of these three semaglutide drugs reach KRW 14 trillion.

Trulicity, which had been leading the injectable diabetes treatment market until last year, maintained a double-digit growth rate and posted annual sales of more than KRW 9 trillion last year, but could not prevent Ozempic from overtaking.

Victoza’s sales recovered from KRW 400 billion in the second quarter to KRW 600 billion in the fourth quarter, keeping annual sales of KRW 2 trillion.

The insulin market continued to decline last year as well. The best-selling drug Lantus (Sanofi) plummeted from KRW 900 billion in the first quarter of last year to KRW 500 billion in the first quarter.

Novo Rapid (Novo Nordisk) maintained the KRW 600-700 billion mark every quarter, overtaking Lantus in the last quarter.

However, in terms of annual sales, Lantus with KRW 3 trillion is still ahead of Novo Rapid with KRW 2.8 trillion.

Humalog (Eli Lilly) also experienced ups and downs every quarter, with annual sales of about KRW 2.6 trillion, down 16.0% from 2021.

Moreover, sales of Tresiba and NOVOMIX (Novo Nordisk) and Humulin and Basaglar (Eli Lilly) decreased compared to 2021.

Tuojeo (Sanofi) rose to the KRW 1.5 trillion mark with a double-digit growth rate, and Ryzodeg and Fiasp (Novo Nordisk) also advanced.

Combination of insulin and GLP-1 RA, Xultophy (Novo Nordisk) exceeded KRW 500 billion, and Soliqua (Sanofi) approached the KRW 300 billion mark.

A dual GIP/GLP-1 RA for the treatment of adults with diabetes Mounjaro (Eli Lilly) achieved sales of KRW 600 billion in the first year of its release.

In the meantime, Saxenda (Novo Nordisk), a weight loss medication, grew by more than 40% and posted nearly KRW2 trillion in sales despite the joining of Wegovy.