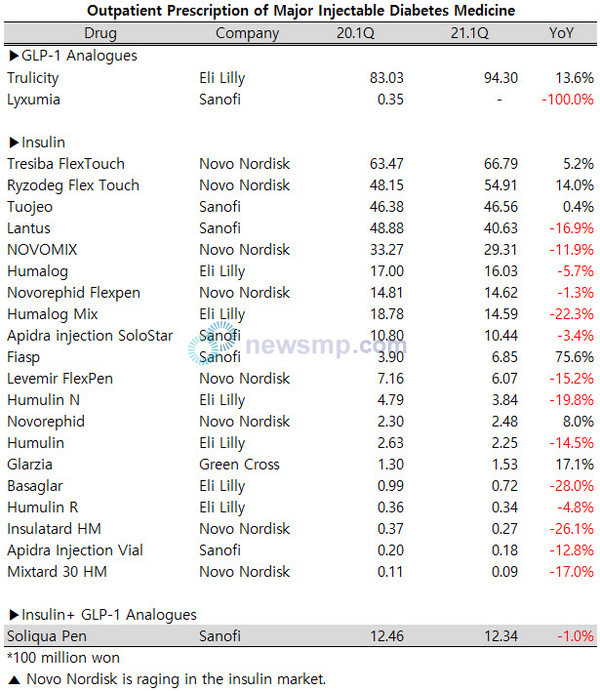

Novo Nordisk is raging in the insulin market.

According to recent UBIST data, Novo Nordisk’s insulins increased their prescription from a year earlier among most of the major insulins.

Tresiba, which became the leader in the insulin market, grew 5.2% YoY to 6.7 billion won.

With a growth of 14.0%, Ryzodeg easily surpassed the 5 billion mark and reached 5.5 billion won, advancing along with Tresiba.

The rapid-acting insulin Fiasp also touched 700 million won mark with 75.6% growth, resulting in three next-generation insulins growing together.

However, most of the existing insulins, such as Novorephid and Insulatard, were sluggish.

Sanofi saw Tiojeo’s prescription remain at a YoY level, while Lantus showed 16.9% contraction, and the prescription of Soliqua, Insulin+ GLP-1 Analogue medication, which had steadily expanded its sales since its launch, decreased slightly from a year earlier.

Lilly’s prescription for insulins such as Humalog, Humulin, and Basaglar has also dropped.

However, the GLP-1 analog Trulicity grew 13.6% to 9.4 billion won, overwhelming other insulins and making up for the poor performance in the insulin market.

Meanwhile, GC Pharma’s Lantus biosimilar Glarzia has grown steadily, exceeding 150 million won in the 1Q of last year.