Hanlim Pharmaceutical 14.0 billion won → 16.6 billion won

Korea Prime PharmㆍKolmar PharmaㆍUnimed Pharmaceuticals ramped up more than 1 billion won

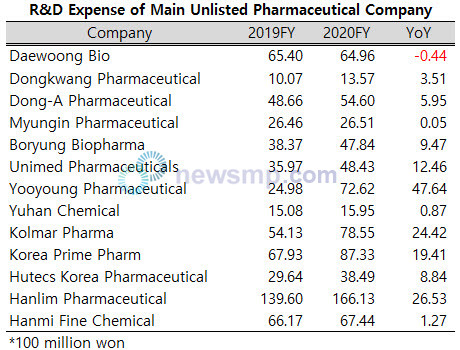

Unlisted pharmaceutical companies have also expanded their research and development (R&D) expenditure as they suffered from depressing performance last year.

Newsmp tallied 13 unlisted pharmaceutical firms’ R&D expense and found that most of them have increased their research fund compared to 2019.

They are Daewoong Bio, Dongkwang Pharmaceutical, Dong-A Pharmaceutical, Myungin Pharmaceutical, Boryung Biopharma, Unimed Pharmaceuticals, Yooyoung Pharmaceutical, Yuhan Chemical, Kolmar Pharma, Korea Prime Pharm, Hutecs Korea Pharmaceutical, Hanlim Pharmaceutical, and Hanmi Fine Chemical.

Among them, 12 companies’ ordinary R%D expense enlarged in 2020 than that of 2019, and Daewoong Bio, the only decreased, was similar to 2019.

The company whose R&D expenditure increased the most last year was Yooyoung Pharmaceutical, that nearly tripled its ordinary R&D expenditure from 2.5 billion won in 2019 to 7.3 billion won last year.

Yooyoung Pharmaceutical’s R&D investment-to-sales ratio also jumped from 2.34% to 6.53. Of the 13 companies, Yooyoung Pharmaceutical saw the largest increase in R&D investment-to-sales ratio as well.

Hanlim Pharmaceutical, the only company out of 13 companies with more than 10 billion won in ordinary R&D expense, added 2.7 billion won and spent 16.6 billion won last year.

Hanlim Pharmaceutical’s ordinary R&D expenditure is close to 10% of its annual sales, and among 13 companies, its R&D investment-to-sales ratio alone exceeds 9%.

Kolmar Pharma was about to reach 100 billion mark in annual sales, but fell from 94.9 billion won to 88.1 billion last year. Despite its poor performance, its R&D expense increased 2.4 billion won to 7.9 billion won.

Kolmar Pharma’s R&D investment-to-sales ratio was 8.92%, the second highest among 13 companies after Hanlim Pharmaceutical, and the second largest increase (3.15%p) after Yooyoung Pharmaceutical.

Of the 13 companies, Korea Prime Pharm, the second largest in ordinary R&D expense after Hanlim Pharmaceutical, increased 1.9 billion won last year to 8.7 billion won, and Unimed Pharmaceuticals also expanded more than 1 billion won from 3.6 billion won to 4.8 billion won.

Boryung Biopharma and Hutecs Korea Pharmaceutical expanded about 900 million won, Dong-A Pharmaceutical about 600 million, Dongkwang Pharmaceutical about 400 million, while Hanmi Fine Chemical, Yuhan Chemical, and Myungin Pharmaceutical also stretched their ordinary R&D expenses compared to 2019.

The combined ordinary R&D expenses of 13 companies jumped 16 billion won and 25.7% from 62.2 billion won in 2019 to 78.2 billion won in 2020, and accordingly, the share of total sales increased from 2.80% to 3.46%.