Cabenuva reaches KRW 150 billion in a year and a half

[Newsmp] Biktarvy (Gilead Sciences) has been a dominant player in the HIV treatment market.

Cabenuva (GSK), as a long-acting injectable drug, heralded a change in the oral drug-oriented HIV treatment market and is growing its presence.

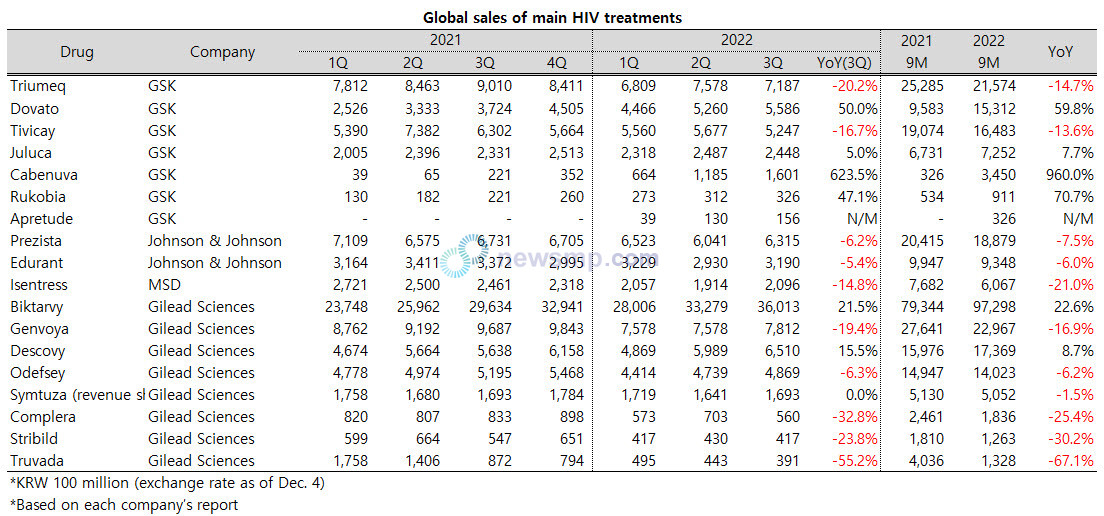

Biktarvy’s sales exceeded KRW 3.5 trillion in the third quarter, according to reports. (Exchange rate as of Dec. 4)

Biktarvy, the only HIV treatment to achieve quarterly sales in trillions, is overwhelming the competitors by expanding its sales to more than 20%, or KRW 3.6013 trillion, in the third quarter.

This is an increase of KRW 273.4 billion compared to the preview two quarters, which alone exceeds the quarterly sales of a few HIV treatments.

The increase in sales from the previous year amounted to KRW 638 billion. Among the major HIV treatments, only three drugs, Triumeq (GSK), Genvoya (Gilead Sciences) and Descovy (Gilead Sciences), exceeded this level in the third quarter.

Although Biktarvy already recorded sales that overpower other players, Biktarvy is strengthening its market dominance by surpassing them in sales growth as well.

Cumulative sales for nine months reached KRW 9.73 trillion, an increase of KRW 1.7955 trillion, or 22.6%, compared to the same period last year, approaching the KRW 10 trillion mark.

In addition to Biktarvy, Gilead posted sales of more than KRW 500 billion in Genvoya with KRW 781.2 billion and Descovy with KRW 651 billion, and Odefsey was close to KRW 500 billion with KRW 486.9 billion.

On the other hand, Truvada, which was the largest-selling drug in the HIV treatment market in the past and the first to secure an indication of prophylaxis, saw its sales decrease below KRW 40 billion in the third quarter.

Triumeq, GSK’s leading drug, is leading a change in the HIV treatment market by diversifying its formulations and posted KRW 700 billion in sales in the third quarter but fell more than 20% from the same period last year.

Dovato grew 50% and expanded to KRW 558.6 billion, surpassing Tivicay (KRW 524.7 billion), a starting player.

Tivicay maintained sales of KRW 500 billion for four consecutive quarters but fell 16.7% from the same period last year.

In the meantime, a long-acting injectable drug Cabenuva, which entered the market last year, is increasing its presence. Cabenuva’s sales in the third quarter exceeded KRW 150 billion to KRW 160.1 billion, which is expected to easily reach KRW 500 billion this year.

Amid the competition between Gilead Sciences and GSK, Johnson & Johnson (Janssen)’s Prezista and Edurant achieved sales of KRW 631.5 billion and KRW 319 billion in the third quarter, but both fell more than 5% from the same period last year.

MSD’s Isentress also recovered to the KRW 200 billion mark, but fell nearly 15% year-on-year, further solidifying the duopoly of Gilead Sciences and GSK.