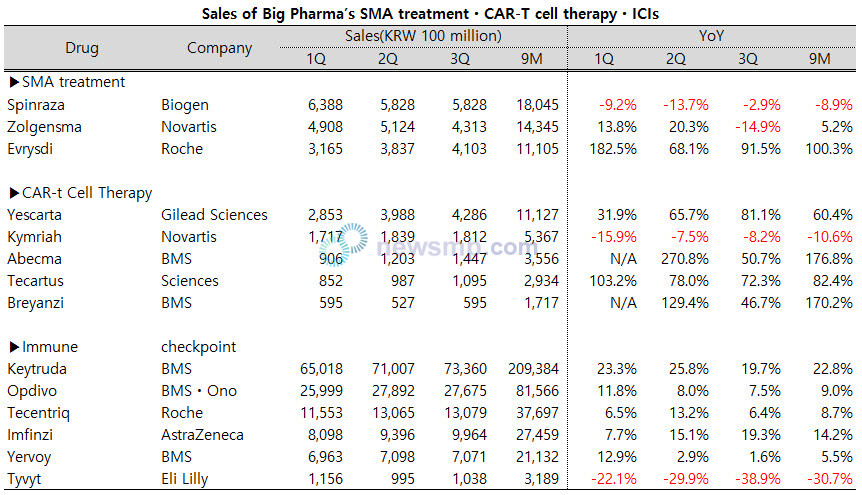

[Newsmp] The negative growth of leaders in the SMA treatment and CAR-T cell therapy market, where the number of players increased, continues.

On the other hand, in the cancer immunotherapy market, Keytruda, which left competitors far behind, is widening the gap with a growth rate that exceeds that of other products.

According to quarterly reports of major global Big Pharma, Evrysdi (Roche), a latecomer, quickly expanded its sales and closely caught up with the starters in the SMA treatment market.

Evrysdi surpassed KRW 400 billion in sales in the third quarter (exchange rate as of Nov. 23), narrowing the tap with Zolgensma (Novartis) to about KRW 20 billion.

The space between Spinraza (Biogen) and Evrysdi, which had a difference of KRW 330 billion in the first quarter, also halved to about KRW 170 billion in the third quarter.

Due to the rapid growth of Evrysdi, Spinraza has shrunk, recording negative growth for the third straight quarter. The cumulative sales volume for the three quarters decreased by 8.9% from the same period last year.

Zolgensma maintained double-digit growth until the first half but fell 14.9% in the third quarter. The sales were reduced from the KRW 500 billion mark to the early KRW 400 billion mark.

In the CAR-T cell therapy market, Yescarta (Gilead Sciences) which had slow growth at the beginning, expanded its growth rate and exceeded KRW 400 billion in the third quarter.

Compared to the same period last year, the growth rate is also rising sharply from 31.9% in the first quarter to 65.7% in the second quarter and 81.1% in the third quarter.

In contrast, Kymriah (Novartis), the only CAR-T cell therapy product in Korea to be covered by health insurance, recorded negative growth for three consecutive quarters this year, resulting in a 10.6% decrease in nine-month sales from the same period last year.

As the quarterly sales of Abecma (BMS) and Tecartus (Gilead Sciences) have surpassed KRW 100 billion, they are approaching Kymriah, which is stuck at KRW 180 billion. In the meantime, Breyanzi (BMS) posted sales of KRW 50 billion for three consecutive quarters.

Unlike the SMA treatments or CAR-T cell therapy market, where latecomers are raging, Keytruda (MSD) still dominates the immune checkpoint inhibitors market.

Keytruda grew by nearly 20% in the third quarter, the highest growth rate among major immune checkpoint inhibitors. The nine-month sales increased by 22.8% from the same period last year, exceeding KRW 20 trillion.

Followed by Keytruda, Opdivo (BMSㆍOno) and Tecentriq (Roche) saw their growth fall to single digits, while Imfinzi (AstraZeneca) is expanding its growth, but Imfinzi fell short of Keytruda.

Tyvyt, which Eli Lilly introduced from Innovent China, saw a steep rise in negative growth, approaching the negative 40% mark in the third quarter. The cumulative sales volume for the three quarters was about KRW 320 billion, down 30.7% from the same period last year.