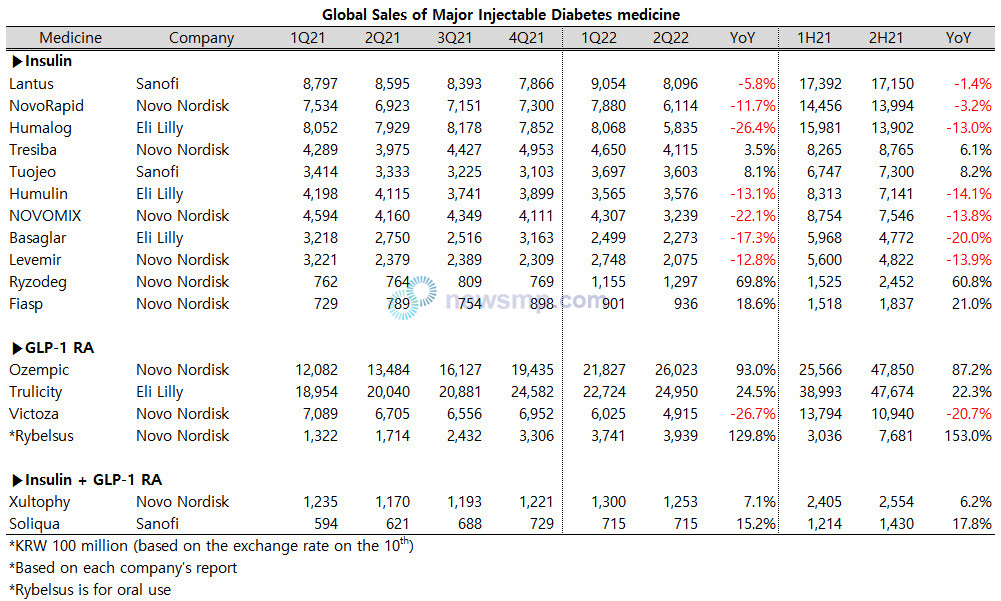

[Newsmp] Ozempic (Novo Nordisk) has overtaken Trulicity (Lilly), which has been leading the injectable diabetes medicine market.

As a result of Newsmp compiled the quarterly reports of major global big pharma, Novo Nordisk’s GLP-1 analogue, Ozempic, achieved sales of about KRW 2.6 trillion in the second quarter, surpassing KRW 2.5 trillion of Trulicity. (Based on the exchange rate on the 10th)

Ozempic has grown rapidly since its launch, threatening Trulicity, and narrowed the gap to KRW 300 billion in the third quarter last year.

In the fourth quarter, the gap between Ozempic and Trulicity widened to about KRW 500 billion again, but it narrowed significantly to less than 100 billion won in the first quarter and succeeded in reversing by about 100 billion won in the second quarter. The semi-annual sales volume was about KRW 4.785 trillion, ahead of Trulicity about KRW 18 billion.

In particular, Ozempic has maintained a growth rate of more than 80% recently, therefore, the gap with Trulicity is expected to widen as Trulicity’s growth rate has decreased to around 20%.

Rybelsus (Novo Nordisk), developed as an oral drug with the same ingredients as Ozempic, grew to 400 billion won in the second quarter, but fell short of the momentum of injections.

In South Korea, Ozempic and Rybelsus have recently been added while Trulicity has dominated the market for injectable diabetes, and it is noteworthy how things are going.

With the release of Ozempic and Rybelsus, the sales of Victoza (Novo Nordisk) decreased to less than KRW 500 billion in the second quarter.

In the insulin market, Lantus (Sanofi) is still leading the market. Lantus continues to grow negatively due to the expiration of patents and the advent of second-generation insulin, but it is still steadily at the forefront with sales of more than KRW 800 billion in the second quarter,

In the fourth quarter of last year, it was threatened with sales of the KRW 700 billion mark with NovoRapid (Novo Nordisk) and Humalog (Eli Lilly), but since then, the gap has widened again.

The second-generation basal insulin, which dug into the limits of Lantus and put the title of ‘next-generation’, slowed significantly in growth despite the huge gap with Lantus.

In the second quarter, Tresiba (Novo Nordisk) recorded sales of about KRW 410 billion and Tuojeo (Sanofi) about KRW 360 billion, with a growth rate of 3~8%.