XevudyㆍLagevrio ↓ 60%

AZㆍModernaㆍPfizer’s vaccines sales decline

Paxlovid 450%↑, over KRW 10 trillion… Janssen vaccine also grows

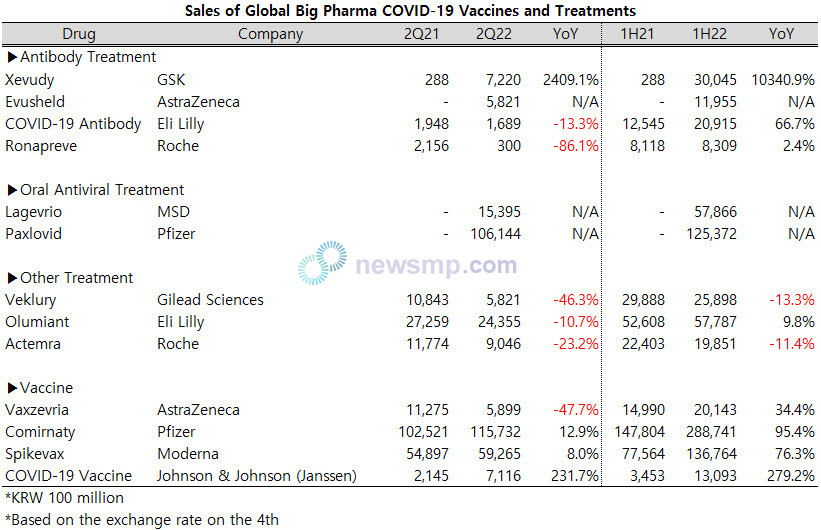

[Newsmp] After the Omicron variant swept the world in the first quarter, the sales of COVID-19 related products are also passing the peak.

Newsmp tallied the global pharmaceutical companies’ second-quarter reports and found that the sales of major COVID-19 treatments and vaccines fell significantly from the first quarter.

In the meantime, Paxlovid (Pfizer) dominated the COVID-19 treatment market, exceeding KRW 10 trillion in sales, more than five times higher than the first quarter.

According to each company’s report, sales of three drugs, Veklury (Gilead Sciences), Actemra (Roche), and Olumiant (Eli Lilly), the early substitutes for COVID-19, all decreased compared to the same period last year.

Veklury, which was first approved as a treatment for severe COVID-19 patients, saw its sales in the second quarter fall by nearly half from the same period last year to about KRW 580 billion (based on the exchange rate on the 4th). Compared to the first quarter, when the sales exceeded more than KRW 2 trillion, it declined by more than 70%.

Sales of Olumiant and Actemra also decreased by more than 10% from the same period the previous year while expanding their indications for COVID-19 treatments.

The momentum of antibody treatments has also been greatly reduced. In particular, the sales of Ronapreve (Roche) in the second quarter were about KRW 30 billion, which was only 4% of the previous quarter.

Eli Lilly’s COVID-19 Antibody plunged more than 90% from the first quarter as well, recording sales of KRW 168.9 billion.

Xevudy (GSK), which took the lead among COVID-19 antibody treatments by generating more than KRW 2 trillion in sales in the first quarter, also saw a sharp decline of nearly 70% from the first quarter.

Sales of Evusheld (AstraZeneca), the pre-exposure prophylaxis for prevention of COVID-19, ramped down 5.1% compared to the first quarter, but the negative growth was the smallest among antibody treatments.

Among oral treatments, Lagevrio (MSD) recorded sales of about KRW 1.54 trillion in the second quarter, down more than 60% from the first quarter when it exceeded KRW 4 trillion.

On the other hand, Paxlovid’s sales surged more than 450% from about KRW 1.92 trillion in the first quarter to KRW 10.61 trillion in the second quarter, effectively monopolizing the COVID-19 treatment market.

The COVID-19 vaccine market is also entering a negative growth trend, and Pfizer’s Comirnaty seems to be dominating.

Comirnaty’s 2Q sales plunged 33.1% from the first quarter to KRW 11.5732 trillion, but it nearly doubled its performance compared to Moderna’s vaccine.

Moderna’s Spikevax sales amounted to about KRW 6 trillion, down 23.5% from the second quarter, but the decrease was less than Comirnaty.

Sales of Vaxzevria (AstraZeneca) plunged nearly 60% from the first quarter, leaving a sluggish performance compared to Johnson & Johnson (Janssen).

Johnson & Johnson’s COVID-19 vaccine was limited by the U.S. FDA in the first quarter, but sales in the second quarter increased more than in the first quarter.

The situation came amid a sales surge outside the U.S. by quadrupling to KRW 700 billion, but sales in the U.S. in the second quarter fell by 10% year-on-year. This is an increase of nearly 20% from KRW 600 billion in the first quarter.