[Newsmp] GLP-1 RA Ozempic (Novo Nordisk), which should be taken once a week, was on a par with the front runner Trulicity (Lilly).

While major guidelines began to prefer GLP-1 RA over basal insulin, the first oral GLP-1 RA product Rybelsus (Novo Nordisk) is poised to surpass the second-generation basal insulin Toujeo (Sanofi), and Tresiba (Novo Nordisk).

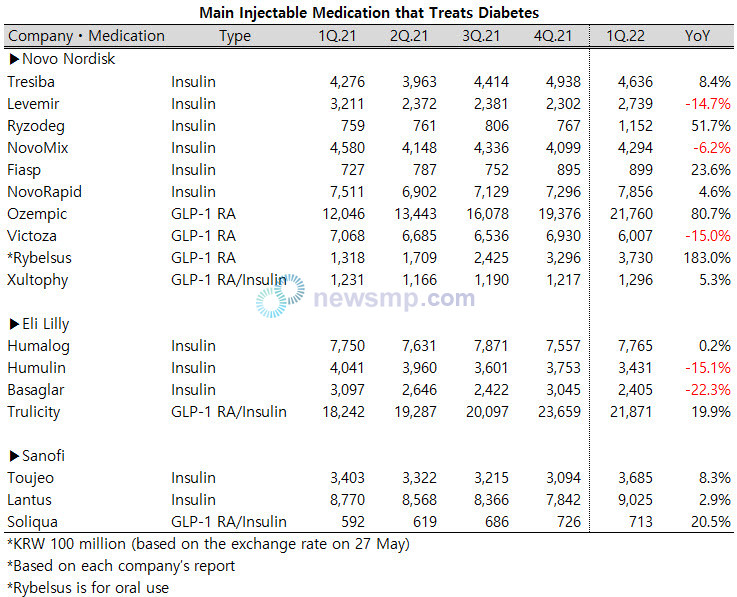

As Newsmp compiled the sales of injectable medications for diabetes based on the quarterly reports of major global big pharmaceuticals, it was confirmed that GLP-1 RA outperforms insulin.

In particular, Ozempic is in high spirits. In the first quarter, it achieved KRW 2.176 trillion in sales with 80.7% year-on-year growth, surpassing KRW 2 trillion, and was on a par with Trulicity, which posted KRW 2.1781 in sales (based on the exchange rate on 27 May).

Trulicity, which exceeded KRW 2 trillion in the third quarter of last year and expanded its sales to KRW 2.3659 trillion in the fourth quarter, retreated to KRW 2.1781 in the first quarter.

Although it maintained a growth rate of nearly 20% compared to the same period last year, sales decreased by about KRW 200 billion from the previous quarter. Considering the exchange rate, it is difficult to estimate the lead between Ozempic and Trulicity.

As Ozempic greatly inflated its sales, Victoza (Novo Nordisk), a once-daily injection, declined by 15.0% compared to the same period of the previous year and pushed back the KRW 600 billion mark.

While Ozempic and Trulicity are leading the injectable diabetes treatment market, the next generation of basal insulins has slowed in the insulin market.

Tresiba (Novo Nordisk) recorded the KRW 400 billion mark in three consecutive quarters while the growth rate was reduced to single digits (8.4%), and left a poorer performance than the fourth quarter.

Toujeo (Sanofi), which had been falling compared to the previous quarter, escaped the slump by expanding sales by nearly 20% compared to the fourth quarter but did not reach the KRW 400 billion mark.

Rather, Lantus (Sanofi) increased its sales again and returned to the KRW 900 billion, surpassing the combined sales of Tresiba and Toujeo.

As a latecomer of NovoMix, Ryzodeg, a soluble formulation of Tresiba and NovoRapid, and Fiasp (Novo Nordisk), which improved the onset time faster than NovoRapid, also recorded growth rates of 51.7% and 23.6%. However, sales were around KRW 100 billion, which was still quite far from KRW 400 billion of NovoMix or KRW 800 billion of NovoRapid.

In the long run, the GLP-1 RA is already overwhelming insulin in terms of sales, and it is also ahead in growth, widening the gap with the new products of insulin.

Meanwhile, although it is a GLP-1 RA, Rybelsus (Novo Nordisk), which was developed as an oral drug, has tripled its size from the same period last year to KRW 373 billion, surpassing Toujeo for two consecutive quarters, and the gap with Tresiba reduced to less than KRW 100 billion.

Xultophy (Novo Nordisk) and Soliqua (Sanofi), which are the combination of insulin and GLP-1 RA, are steadily expanding their sales, but their quarterly sales amounted to only KRW 129.6 billion and KRW 71.3 billion.