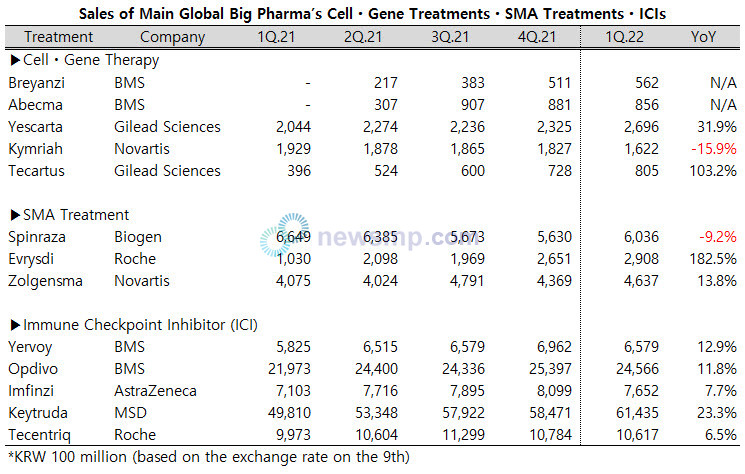

YescartaㆍTecartusㆍBreyanzi grow rapidly… Evrysdi, ↑180%

ICIs, Keytruda’s dominance is strong despite shared growth

[Newsmp] Starting players are slow in the high-end priced treatments market such as cell and gene treatments centered on CAR-T and SMA treatments.

Kymriah (Novartis), which recently gained insurance coverage in Korea as the first CAR-T treatment, saw its quarterly sales decline for four consecutive quarters after recording KRW 193 billion (based on the exchanged rate on the 9th) in the first quarter of last year.

In particular, Kymriah maintained KRW 180 billion from the second quarter of last year to the fourth quarter, but its sales were reduced to KRW 162 billion in the first quarter.

Yescarta, which joined as a latecomer, steadily expanded its sales and rose to about KRW 270 billion in the first quarter, and Tecartus (Gilead) also entered the KRW 80 billion mark. Breyanzi (BMS) is also continuously expanding its sales and approaching the KRW 60 billion mark.

However, Abecma (BMS) rose to the KRW 90 billion mark immediately after its launch, but its sales decreased for the second consecutive quarter, falling to the KRW 85 billion mark in the first quarter.

In the SMA treatment market, the growth of the starters seems to have slowed after the oral drug Evrysdi (Roche) entered the market.

The first SMA treatment Spinraza (Biogen), returned to the KRW 600 billion mark in the first quarter after staying at the KRW 560 mark for the third and fourth quarters of last year, but it was far from KRW 660 billion recorded in the same period last year.

Zolgensma (Novartis), which had remained at the KRW 400 billion mark since the advent of Evrysdi, recovered its growth by rising to KRW 480 billion in the third quarter of last year, but immediately fell to the KRW 430 billion in the fourth quarter.

In the first quarter, it recovered to KRW 460 billion again, achieving double-digit growth compared to the same period last year, but fell short of KRW 480 billion in the previous third quarter.

Among them, Evrysdi is closely chasing the starters, expanding its sales to KRW 290 billion and looking to reach the KRW 300 billion mark.

In the immune checkpoint inhibitor (ICI) market, Keytruda’s dominance has been strengthened.

Although other ICIs have grown, Keytruda is overwhelming its competitors in terms of growth rate with an unrivaled performance.

Keytruda, which entered the KRW 5 trillion mark in quarterly sales last year, recorded more than 20% growth in the first quarter, exceeding KRW 6.1 trillion.

In the meantime, Opdivo (BMS, Ono), which recovered its growth after staying stagnant for a while, also recorded double-digit growth compared to the same period last year, but only half of Keytruda’s growth rate, and its sales decreased slightly from the previous fourth quarter to KRW 2.4 trillion, which exceeded KRW 2.5 trillion.

Along with Opdivo, Yervoy (Bms, Ono) also posted double-digit growth with sales of about KRW 660 billion, but its sales declined slightly as well from the fourth quarter.

Imfinzi (AstraZeneca) and Tecentriq (Roche) remained at a single-digit growth rate with sales of KRW 770 billion and KRW 1.6 trillion, and also showed sluggish performance compared to the fourth quarter.