AbbVie and Pfizer ↑20%... LillyㆍJNJ ↑double-digit growth

Roche shrinks 15.4% due to patent expiration of Avastin

As the advent of the precision medicine era with the development of genome analysis evolves, the weight of Global Big Pharma is rapidly shifting from chronic diseases to anticancer drugs.

Global Big Pharma also fell into a slump in the aftermath of COVID-19 but remained strong in the anticancer drug sector.

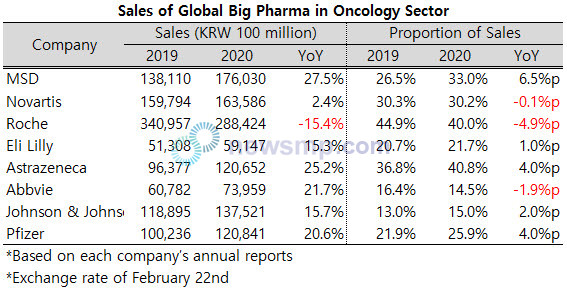

Newsmp separately counted the anticancer drug sector of Global Big Pharma’s annual reports and found that most of them recorded double-digit growth.

In particular, MSD, which dominated the cancer immunotherapy market with Keytruda, reached KRW 17 trillion in sales in the anticancer drug sector last year. This is a 27.5% increase from 2019, and Keytruda alone pulled close to KRW 16 trillion.

As a result, the portion of MSD’s total sales of the anticancer drug also jumped 6.5%p from 26.5% in 2019 to 33.0% last year, exceeding 30%.

AstraZeneca’s anticancer drug division also recorded a growth rate of 25.2% last year with the growth of the third-generation targeted therapy, Tagrisso.

Tagrisso, which started as a secondary treatment for non-small cell lung cancer and recently expanded its potential to early lung cancer, posted annual sales of USD 4.3 billion and approximately KRW 4.8 trillion last year. This is an increase of 16% from 2019.

In addition, Lynparza and Imfinzi grew 8%, with sales of USD 2.2 billion (KRW 2.5 trillion) and USD 2 billion (KRW 2.2 trillion).

Therefore, AstraZeneca’s sales of anticancer drugs increased 4.0%p from 36.8% in 2019 to 40.8%.

AbbVie with Imbruvica and Pfizer with Ibrance also made a growth rate exceeding 20% in the anticancer drug sector.

Pfizer’s sales of anticancer drugs jumped 4.0%p from 21.9% to 25.9%, but AbbVie’s anticancer drugs decreased slightly due to the impact of the merger between Allergan, while new immune disease treatments such as Rinvoq and Skyrizi quickly expanded their presences.

Johnson & Johnson (Janssen) and Lilly’s anticancer drug division also grew more than 15%.

With the growth of Alimta and Cyramza, Lilly’s performance in the anticancer drug division rose remarkably as Verzenio inflated its appearance.

Johnson & Johnson saw a significant decrease in sales of Velcade and Zytiga but showed a successful generational shift as sales of their successors, Darzalex, Erleada, and Imbruvica, soared.

On the other hand, Roche, which made more than KRW 34 trillion in sales in the anticancer drug sector alone in 2019, fell into a slump due to the patent expiration for large drugs such as Avastin and Herceptin.

Roche still boasts overwhelming sales among major Global Big Pharma with sales of KRW 29 trillion last year, but it shrunk 5.4% from 2019.

Accordingly, the proportion of anticancer drugs in total sales decreased by 4.9%p from 44.9% in 2019 to 40.0%.