In the aftermath of COVID-19 in the first quarter, the results of prominent original patent expiration and generics, which centered on chronic diseases, were found to be sluggish.

Nevertheless, the original drugs still made a pleasing outcome among the prevailing medicines.

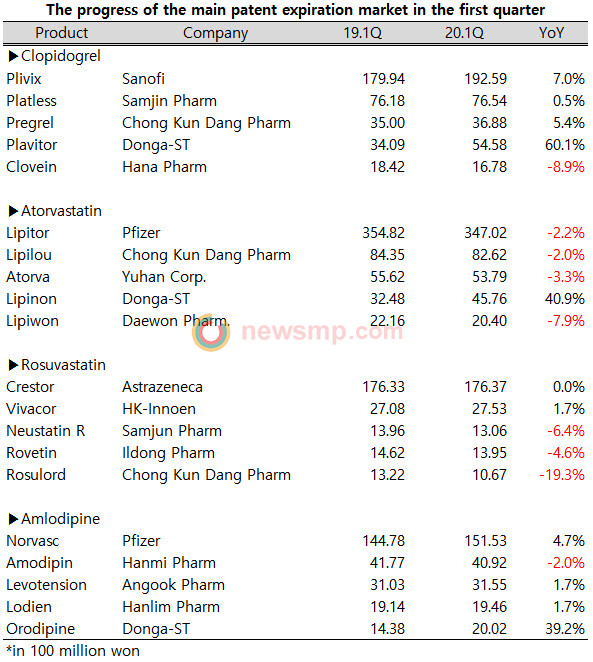

According to IQVIA, one of the popular drugs in the pharmaceutical market, Lipitor’s (Pfizer) performance in the last quarter was 2.2% less than the same period the previous year.

Lipitor, which was ranked NO.1 and has steadily expanded its sales in the pharmaceutical market even with the patent expiration and drug pricing reduction, yielded the top position with slight degrowth.

In the same period, major generics such as Lipilou (Chong Kun Dang Pharm.), Atorva (Yuhan Corp.), and Lipiwon (Daewon Pharm.) also experienced a 2~8% degrowth, that made Lipitor’s degrowth seem relatively small.

At the same time, the result of Crestor (AstraZeneca) also lasted at the same level showing a slowdown in growth.

Moreover, popular generics like Neustatin R (Samjin Pharm.), Rovetin (Ildong Pharm.), Rosulord (Chong Kun Dang Pharm.), etc. recorded negative growth, showing a more stagnant period. In contrast, Vivacor (HK inno.N Corp.), which demonstrated positive growth alone, showed only 1.7% growth.

Norvasc (Pfizer) grew 4.7% and made a profit of $15 billion, while Amodipin’s (Hanmi) sales decreased by 2.0%, and Levotension (Ahn-Gook) and Lodien (Hanlim Pharm.) abided in 1.7% growth.

Plavix (Sanofi), which has recently been running in reverse, increased its sales to $19 billion in the first quarter, recording a growth rate of 7.0%.

Platless (Samjin Pharm.) once dreamed about success in generics with similar sales to Plavix but grew only 0.5% during the same period and stayed at $7.7 billion, widening the gap between the two to nearly $12 billion.

Pregrel (Chong Kung Dang Pharm.) also recorded a growth rate of 5% amid a slump in chronic disease treatments, but failed to reach the growth rate of Plavix, and Clovein (Hana Pharm.) grew 8.9% reversely.

Meanwhile, major generics remained inactive, but sales of DongA-St drugs increased significantly due to demand research, which is facing suspension of sales.

In particular, sales of Plavitor increased by more than 60% compared to the same period last year, and Lipinon and Orodipine also showed growth rates of around 40%.