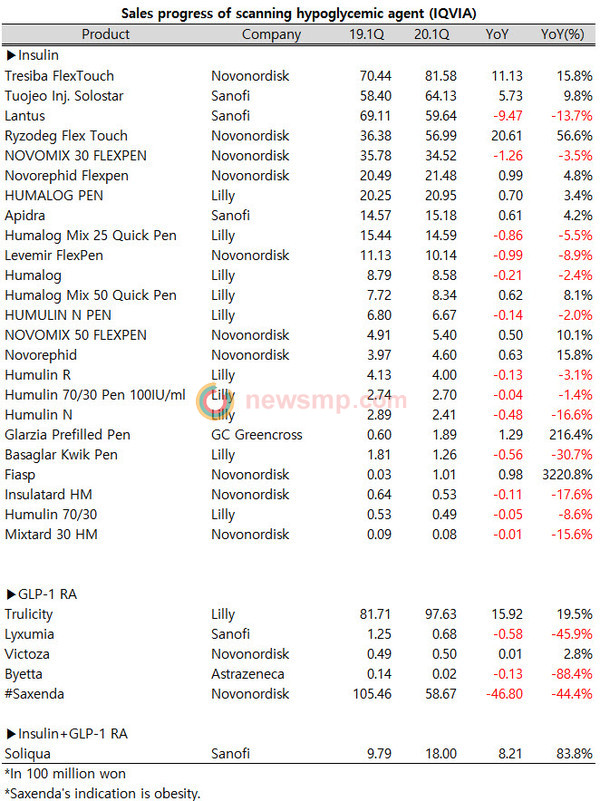

Tresiba $8.2 billion… widen the gap with Toujeo by $1.7 billion

Lantus falls behind Toujeo, Ryzodeg is also catching up

Although the Trulicity (Lilly) is ahead of GLP-1 Analogues in the insulin market, the competition of the leading group is intense.

According to IQVIA, Tresiba (Novo Nordisk)’s walkover was remarkable in the first quarter of the insulin market. Among the first and second generation of basal insulin, only the Tresiba made $8 billion in sales with a growth rate of two digits.

Also, Toujeo’s sales rose to $6 billion with a growth rate of 10% and surpassed that of Lantus (Sanofi), but the gap between Toujeo and Tresiba widened from $1.2 billion to $1.7 billion.

Lantus steadily declined to $5.9 billion in the first quarter due to the offensive latecomers and the emergence of biosimilars.

Meanwhile, Ryzodeg (Novo Nordisk) expanded its sales to $5.7 billion with a growth of 60% and pursued fighting for the lead by chasing Lantus.

In the fierce competition of the leading group, existing products such as Novomix, Novorephid, Levermir (Novo Nordisk), Humalog, Humulin (Lilly), and Apidra (Sanofi), etc. are spinning their wheels.

In the Lantus biosimilar, the latecomer Glarzia (Green Cross Corp.) with sales of late $100 million overtook Basaglar (Lilly), whose sales reached the early $100 million.

Basaglar, which had expanded its growth beyond the slow pace after its launch, had shrunk its quarterly sales back to $100 million from $2 million when Glarzia emerged afterward.

Fiasp (Novo Nordisk) is attempting a paradigm shift to rapid-acting insulin but has just passed $100 million in quarterly sales, which resulting little attention than expected.

Trulicity, which surpassed competitive insulin drugs despite being a GLP-1 Analogues, became the market leader in scanning hypoglycemic agents and continued to develop nearly 20$ in the first quarter.

However, Trulicity exceeded $10 billion for the first time in the fourth quarter of last year but retreated to $9.8 billion in the first quarter, which made to withdraw from $10 billion range.

Trulicity alone is leading the market while other GLP-1 Analogues’ quarterly sales are below $100 million.

In the meantime, Saxenda (Novo Nordisk), which made more than $10 billion in quarterly sales as an indication of obesity rather than diabetes mellitus, decreased its sales by almost half in the first quarter, down to $5.9 billion.

So far, Soliqua (Sanofi), the only insulin+GLP-1 Analogue combination, has doubled its sales to $1.8 billion.