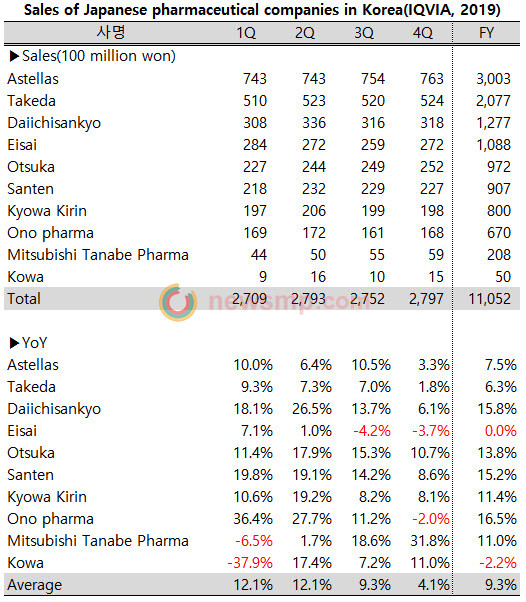

Growth slowed in 2H...9.3% in 3Q, plunging to 4.1% in 4Q

Some of the effects was due to worsening anti-Japanese sentiment

Japanese pharmaceutical companies, which had been ridden high, have lost steam.

According to IQVIA, the average sales growth rate of 10 Japanese pharmaceutical companies last year remained at single digits of 9.3%.

In particular, the growth rate dropped significantly since the second half of last year, when Korea-Japan relationship deteriorated and a boycott of Japanese products had been in full swing.

The average sales growth of 10 companies, which had maintained 12.1% for the first and second consecutive quarters, fell to 9.3% in the third quarter, and plunged to 4.1% in the fourth quarter.

Among these companies, Eisai showed the worst performance with negative growth rates for the third and fourth consecutive quarters.

While the growth rate has slowed down, the lowering drug price of Aricept, the biggest product, is deepening the slump.

However, the sales of Lenvima greatly improved as reimbursement coverage expanded to include first-line treatment of liver cancer after years of hard work. And Fycompa, Symbenda, Tecfidera, etc. are also on the rebound, entering a upward trend.

Ono pharma, which entered the market with only one product of Opdivo, has experienced negative growth tread in the fourth quarter.

Ono’s sales growth, which reached 36.4% in the first quarter, fell to 27.7% in the second quarter and 11.2% in the third quarter, and eventually fell to negative growth rate in the fourth quarter.

While discussions with the regulatory authority to expand reimbursement has not progressed, the position of Opdivo is narrowing as competitive products have rapidly gain market share.

Coincidentally, Opdivo sales started to negative growth last year not only in Korea but also in global markets. The annual sales in Korea are amounted to 67 billion won, but it seems like it is no time to relax.

Takeda also saw its growth slow down every quarter. In particular, the company was directly hit by a boycott because the proportion of generic drugs was higher than other companies.

It started at 9.3% in the first quarter and maintained a 7% growth rate until the third quarter, but plunged to 1.8% in the fourth quarter.

As the competition in the market for osteoporosis treatment intensified, Evista sales decreased significantly, and sales of generic drug such as Actinum series, Whituben series, Albothyl plummeted in the aftermath of a boycott, fueling sluggish performance.

Astellas saw only 3.3% growth rate in the fourth quarter, and Santen, Kyowa Kirin also showed the lowest growth rate of the year with single digits.

Otsuka recorded double digits growth rate, but it was the lowest compared to the growth rates in the first to third quarters.

On the other hand, Mitsubishi Tanabe Pharma is known as a subsidiary of the Mitsubishi Group, which is one of the companies involved in the war crimes of forced labor and comfort women, however, steadily increased its growth and exceeded 30% in the fourth quarter.

In particular, despite the fact that the company suddenly withdrew application for Radicut reimbursement during negotiations in June, when Korea-Japan relationship deteriorated in earnest, Radicut sales growth rate was more than 40% in the fourth quarter, leaving a bitter aftertaste.